SBFC Finance Shows Strong Growth and Positive Market Indicators Amid Evaluation Adjustment

2025-04-03 08:14:17SBFC Finance has recently adjusted its evaluation, reflecting strong financial metrics and positive technical indicators. The company reported significant growth in net sales and operating profit, maintaining a robust performance over the past six quarters. High institutional holdings further highlight its appeal in the finance sector.

Read MoreSBFC Finance Shows Bullish Technical Trends Amid Market Dynamics and Resilience

2025-04-03 08:06:38SBFC Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 92.85, showing a notable increase from the previous close of 89.59. Over the past year, SBFC Finance has demonstrated a return of 10.61%, outperforming the Sensex, which recorded a return of 3.67% in the same period. The technical summary indicates a bullish sentiment in various indicators. The MACD on a weekly basis is bullish, while the Bollinger Bands also reflect a bullish trend both weekly and monthly. Daily moving averages support this positive outlook. However, the KST shows a mildly bearish trend on a weekly basis, suggesting some caution in the short term. In terms of price performance, SBFC Finance has reached a 52-week high of 105.72 and a low of 77.00, with today's trading reflecting a high of 94.22 and a low of 89.21. ...

Read MoreSBFC Finance Ltd Outperforms Sensex with Strong Annual and Year-to-Date Returns

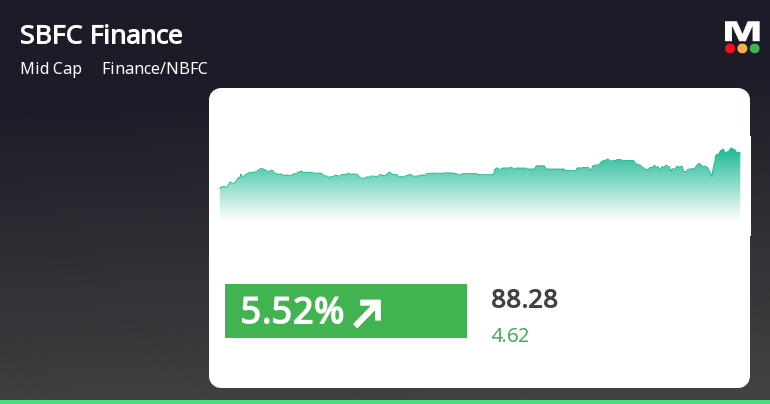

2025-04-02 18:00:08SBFC Finance Ltd, a mid-cap player in the Finance/NBFC sector, has shown significant activity today, with a notable increase of 3.64% in its stock price. This performance stands in contrast to the Sensex, which rose by only 0.78%. Over the past week, SBFC Finance has outperformed the benchmark index, gaining 4.93% compared to the Sensex's decline of 0.87%. In terms of annual performance, SBFC Finance has delivered a return of 10.61%, significantly surpassing the Sensex's 3.67%. The company's year-to-date performance also reflects resilience, with a gain of 2.27% against the Sensex's decline of 1.95%. Key technical indicators suggest a bullish sentiment in the short term, with moving averages and Bollinger Bands signaling positive momentum. However, the KST indicator shows a mildly bearish trend on a weekly basis. The stock's price-to-earnings ratio stands at 31.10, notably higher than the industry averag...

Read MoreSBFC Finance Shows Mixed Technical Trends Amid Strong Weekly Performance

2025-03-25 08:06:33SBFC Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 89.60, showing a notable increase from the previous close of 87.62. Over the past week, SBFC Finance has demonstrated a strong performance with a return of 8.55%, outpacing the Sensex, which returned 5.14% in the same period. In terms of technical indicators, the weekly MACD is bullish, while the monthly indicators present a mixed picture with some showing sideways movement. The Bollinger Bands indicate a bullish trend on a weekly basis, suggesting potential volatility, while moving averages reflect a mildly bearish sentiment on a daily scale. The KST shows a bearish trend weekly, contrasting with the monthly bullish outlook of the On-Balance Volume (OBV). When comparing the stock's performance over various time frames, SBFC Financ...

Read More

SBFC Finance Outperforms Sector Amid Broader Market Recovery and Positive Trends

2025-03-21 15:20:28SBFC Finance has experienced notable trading activity, outperforming its sector and reaching an intraday high. The stock is currently above key moving averages, indicating a positive trend. Meanwhile, the broader market, led by small-cap stocks, has shown recovery after a negative start. Year-to-date, SBFC Finance has seen a slight decline.

Read MoreSBFC Finance Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-21 08:03:27SBFC Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 83.66, slightly down from the previous close of 84.53. Over the past year, SBFC Finance has shown a return of 8.17%, outperforming the Sensex, which recorded a return of 5.89% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show no significant signals. The Bollinger Bands indicate a mildly bearish trend on a weekly basis, with a sideways movement observed monthly. Daily moving averages also reflect a bearish sentiment, while the On-Balance Volume (OBV) shows no trend on a weekly basis but is mildly bullish monthly. The stock's performance over various time frames reveals a mixed picture. In the last week, SBFC Finance returned 0.59%, while the Sensex gained 3.41%. ...

Read MoreSBFC Finance Faces Technical Trend Shifts Amidst Market Evaluation Revision

2025-03-20 08:04:20SBFC Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 84.53, slightly above its previous close of 84.23. Over the past year, SBFC Finance has shown a return of 7.31%, outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD is indicating a bearish trend, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands show a mildly bearish trend on a weekly basis, suggesting some volatility in the stock's price movement. The KST and Dow Theory indicators further reinforce the bearish outlook on a weekly basis. Despite these technical signals, SBFC Finance has demonstrated resilience in its annual performance compared to the Sensex. The stock's 52-week high stands at 105.72, while the low is re...

Read MoreSBFC Finance Navigates Complex Market Landscape Amid Mixed Performance Indicators

2025-03-19 18:00:47SBFC Finance, a mid-cap player in the Finance/NBFC sector, has shown notable activity in the stock market today. With a market capitalization of Rs 9,400.00 crore, the company has a price-to-earnings (P/E) ratio of 28.31, which is significantly higher than the industry average of 20.91. Over the past year, SBFC Finance has delivered a performance of 7.31%, outperforming the Sensex, which recorded a gain of 4.77%. In the short term, the stock has seen a daily increase of 0.36%, compared to the Sensex's 0.20% rise. However, its weekly performance shows a modest gain of 1.23%, lagging behind the Sensex's 1.92% increase. On a monthly basis, SBFC Finance has gained 0.98%, while the Sensex has declined by 0.65%. Despite a challenging three-month period with a decline of 2.62%, the stock's year-to-date performance stands at -6.90%, compared to the Sensex's -3.44%. Technical indicators suggest a bearish trend...

Read MoreSBFC Finance Ltd Sees Surge in Trading Activity Amid Mixed Performance Trends

2025-03-19 11:00:07SBFC Finance Ltd, a mid-cap player in the Finance/NBFC sector, has emerged as one of the most active equities today, with a total traded volume of 16,187,317 shares and a total traded value of approximately Rs 1,339.99 crore. The stock opened at Rs 84.96, reaching a day high of Rs 88.55 and a day low of Rs 82.00, before settling at a last traded price of Rs 85.29. Despite this activity, SBFC Finance has underperformed its sector by 0.86% today. However, it has shown resilience with a consecutive gain over the last two days, yielding a return of 2.49% during this period. The stock's performance relative to moving averages indicates it is currently above the 5-day moving average but below the 20-day, 50-day, 100-day, and 200-day averages. Investor participation has notably increased, with a delivery volume of 1,075,000 shares on March 18, reflecting a 60.87% rise compared to the 5-day average delivery volum...

Read MoreShareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

08-Apr-2025 | Source : BSEPlease find attached.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

08-Apr-2025 | Source : BSEPlease find attached.

Closure of Trading Window

26-Mar-2025 | Source : BSEPlease find attached

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available