Shiva Texyarn Faces Technical Divergence Amidst Profitability Challenges and High Debt Levels

2025-03-27 08:00:41Shiva Texyarn, a microcap textile company, has experienced a recent evaluation adjustment reflecting shifts in technical trends. While the stock has returned 29.57% over the past year, it faces challenges with declining operating profits and a high debt-to-EBITDA ratio, indicating potential difficulties in long-term profitability.

Read MoreShiva Texyarn Faces Short-Term Challenges Despite Strong Long-Term Performance in Textile Sector

2025-03-26 18:00:16Shiva Texyarn Ltd, a microcap player in the textile industry, has shown notable activity in the market today. The company's market capitalization stands at Rs 240.00 crore, with a price-to-earnings (P/E) ratio of 21.01, which is below the industry average of 29.98. Over the past year, Shiva Texyarn has delivered a performance of 29.57%, significantly outperforming the Sensex, which recorded a gain of 6.65%. However, recent trends indicate a decline, with the stock down 2.51% today, compared to a 0.93% drop in the Sensex. In the short term, the stock has faced challenges, with a 4.21% decrease over the past week and a 9.70% decline in the last month. Year-to-date, Shiva Texyarn is down 17.62%, while the Sensex has only seen a minor decline of 1.09%. Longer-term performance shows a mixed picture, with a 155.06% increase over five years, slightly lagging behind the Sensex's 158.09% rise. The technical in...

Read More

Shiva Texyarn Reports Q3 FY24-25 Growth Amid Long-Term Financial Challenges

2025-02-08 08:55:11Shiva Texyarn, a microcap textile company, has recently experienced an evaluation adjustment amid mixed performance indicators. While the latest quarter showed positive profit growth, challenges remain in long-term fundamentals and debt management. The stock has demonstrated resilience, outperforming the broader market over the past year.

Read More

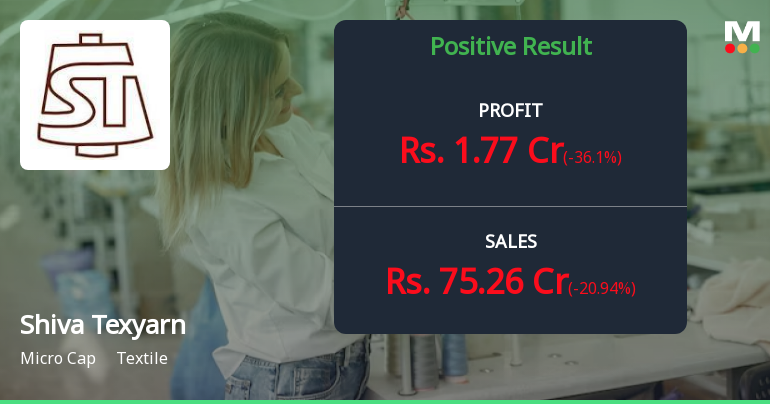

Shiva Texyarn Reports Strong PAT Growth Amid Declining Inventory and Debtors Ratios

2025-02-06 17:25:11Shiva Texyarn has announced its financial results for the quarter ending December 2024, showcasing significant growth in Profit After Tax, which reached Rs 4.54 crore. However, the company faces challenges with declining Inventory and Debtors Turnover Ratios, indicating slower inventory sales and debt settlement.

Read More

Shiva Texyarn Reports Strong Q2 FY24-25 Growth Amid Long-Term Challenges

2025-02-03 18:21:25Shiva Texyarn, a microcap textile company, reported a profit after tax of Rs 2.77 crore for Q2 FY24-25, alongside net sales of Rs 95.19 crore. Despite strong quarterly performance, challenges persist with long-term fundamentals, including a negative CAGR in operating profits and a high debt to EBITDA ratio.

Read More

Shiva Texyarn Reports Strong Q2 FY24-25 Growth Amid Long-Term Financial Challenges

2025-01-27 18:31:11Shiva Texyarn, a microcap textile company, recently adjusted its evaluation amid positive second-quarter FY24-25 results, including a notable profit after tax increase and rising net sales. However, challenges persist with long-term fundamentals, including a declining operating profit CAGR and high debt levels, despite strong annual stock performance.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31.03.2025.

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window

Announcement Under Regulation 30 Of SEBI (LODR) Regulations 2015

14-Mar-2025 | Source : BSEThe intimation as required under Regulation 30 of SEBI (LODR) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Shiva Texyarn Ltd has declared 14% dividend, ex-date: 02 Sep 22

No Splits history available

No Bonus history available

No Rights history available