Subros Experiences Technical Trend Shift Amid Mixed Market Sentiment and Performance

2025-03-27 08:02:49Subros, a small-cap player in the auto ancillary industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 570.50, down from a previous close of 590.45. Over the past year, Subros has experienced a stock return of 9.02%, outperforming the Sensex, which recorded a return of 6.65% in the same period. However, in the shorter term, the stock has faced challenges, with a year-to-date return of -8.35%, contrasting with the Sensex's decline of just -1.09%. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions. Despite these trends, the On-Balance Volume (OBV) suggests a mildly bullish stance on both weekly and monthly scales. In terms of price performance, Subros has seen fluctua...

Read MoreSubros Experiences Technical Trend Shifts Amidst Strong Long-Term Performance

2025-03-25 08:04:30Subros, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 605.10, showing a notable increase from the previous close of 587.85. Over the past year, Subros has demonstrated a stock return of 11.82%, outperforming the Sensex, which returned 7.07% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals on both weekly and monthly charts, indicating a neutral momentum. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Daily moving averages also reflect a mildly bearish sentiment. Subros has shown impressive long-term performance, with a staggering 377.02% return over the past five years, significantly su...

Read More

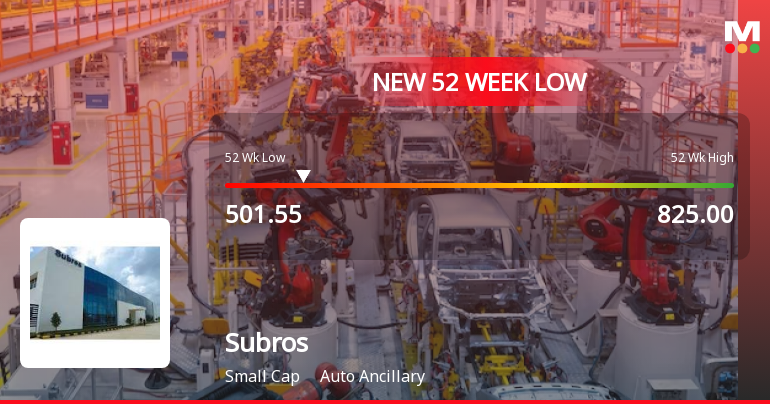

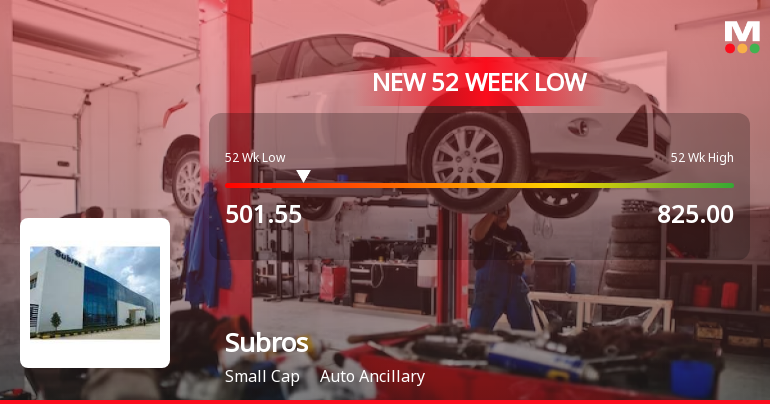

Subros Faces Volatility Amid Strong Financial Performance and Low Debt Levels

2025-03-17 09:52:07Subros, an auto ancillary company, has faced significant stock volatility, reaching a new 52-week low. Despite recent declines, it has shown resilience over the past year with a return of 6.87%. The company maintains a low debt-to-equity ratio and positive financial performance indicators, attracting institutional interest.

Read More

Subros Faces Volatility Amid Strong Yearly Performance and Low Debt Levels

2025-03-17 09:52:05Subros, an auto ancillary company, has faced significant stock volatility, reaching a new 52-week low. Despite recent declines, it has shown resilience with a 6.87% annual return. The company maintains a low debt-to-equity ratio and has reported positive financial results for six consecutive quarters, attracting institutional interest.

Read More

Subros Faces Volatility Amidst Strong Financial Performance and Growth Constraints

2025-03-17 09:52:05Subros, an auto ancillary company, has faced significant volatility, reaching a new 52-week low. Despite recent declines, it has shown resilience with a 6.87% return over the past year. The company maintains a strong financial position, with consistent profit growth and a low debt-to-equity ratio, though long-term growth prospects appear limited.

Read MoreSubros Experiences Technical Trend Shifts Amidst Evolving Market Dynamics

2025-03-10 08:01:31Subros, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 584.30, showing a notable increase from the previous close of 572.65. Over the past year, Subros has demonstrated a stock return of 3.10%, outperforming the Sensex, which recorded a return of 0.29%. In terms of technical indicators, the weekly MACD is positioned in a bearish trend, while the monthly MACD shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a sideways movement monthly. Daily moving averages reflect a bearish sentiment, while the KST shows a mildly bullish trend weekly but shifts to mildly bearish monthly. Subros has shown resilience over longer periods, with a rema...

Read MoreSubros Experiences Valuation Grade Change Amid Competitive Auto Ancillary Landscape

2025-03-10 08:00:39Subros, a small-cap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 584.30, reflecting a notable shift from its previous close of 572.65. Over the past year, Subros has demonstrated a stock return of 3.10%, outperforming the Sensex, which recorded a modest 0.29% return in the same period. Key financial metrics for Subros include a PE ratio of 28.29 and an EV to EBITDA ratio of 12.07, indicating its market positioning within the industry. The company also boasts a return on capital employed (ROCE) of 18.58% and a return on equity (ROE) of 12.68%, showcasing its operational efficiency. In comparison to its peers, Subros presents a higher valuation profile, particularly when looking at the PE ratio, which is significantly above that of companies like Sharda Motor and Lumax Auto Tech. While Subros has shown resilience over longer period...

Read MoreSubros Faces Mixed Technical Trends Amidst Evolving Auto Ancillary Market Dynamics

2025-03-07 08:02:53Subros, a small-cap player in the auto ancillary industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 572.65, showing a slight increase from the previous close of 568.20. Over the past year, Subros has demonstrated a return of 0.80%, slightly outperforming the Sensex, which recorded a return of 0.34%. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish trend for both time frames, and moving averages on a daily basis also reflect bearish sentiment. However, the KST presents a mildly bullish stance on a weekly basis, contrasting with its monthly mildly bearish position. Subros has shown resilience over longer periods, with a remarkable ...

Read MoreSubros Experiences Valuation Grade Change Amidst Competitive Auto Ancillary Landscape

2025-03-04 08:00:16Subros, a small-cap player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 540.05, down from a previous close of 570.85, with a 52-week range between 483.65 and 825.00. Key financial metrics include a PE ratio of 26.14 and an EV to EBITDA ratio of 11.12, indicating its market positioning relative to peers. In comparison to other companies in the industry, Subros maintains a competitive edge with a PEG ratio of 0.45, which is lower than several peers, suggesting a favorable growth outlook relative to its valuation. While its return metrics show a decline over the past week and month, the company has demonstrated significant growth over longer periods, with a 10-year return of 753.83%, outperforming the Sensex's 146.96% in the same timeframe. Overall, the evaluation revision highlights Subros's current ...

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

09-Apr-2025 | Source : BSECopy of Newspaper Publication

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

08-Apr-2025 | Source : BSENotice of Postal Ballot

Board Meeting Outcome for Outcome Of Board Meeting

28-Mar-2025 | Source : BSEOutcome of the Board Meeting

Corporate Actions

No Upcoming Board Meetings

Subros Ltd has declared 90% dividend, ex-date: 11 Sep 24

Subros Ltd has announced 2:10 stock split, ex-date: 20 Nov 07

No Bonus history available

No Rights history available