Suryoday Small Finance Bank Faces Significant Volatility Amid Declining Performance Metrics

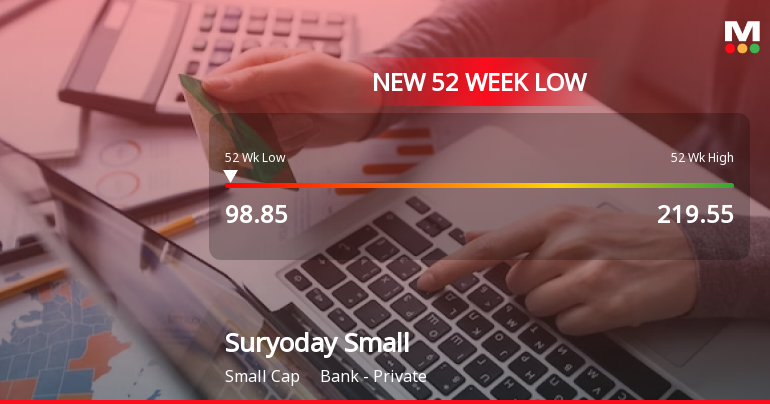

2025-03-17 10:40:00Suryoday Small Finance Bank has faced significant volatility, hitting a 52-week low and showing a notable decline over the past year. Financial metrics indicate challenges, including a drop in quarterly profit and a high NPA ratio. However, the bank maintains a strong capital adequacy ratio and has demonstrated long-term growth in net interest income and profit.

Read More

Suryoday Small Finance Bank Faces Stock Volatility Amid Declining Profitability and Rising NPAs

2025-03-13 12:07:55Suryoday Small Finance Bank's stock has faced notable volatility, recently hitting a 52-week low and declining 14.55% over four days. The bank reported a 43% drop in quarterly profit year-over-year, while its gross non-performing asset ratio reached 5.53%. However, it maintains a strong capital adequacy ratio of 36.90%.

Read More

Suryoday Small Finance Bank Faces Volatility Amid Broader Market Declines and Profit Challenges

2025-03-12 11:08:30Suryoday Small Finance Bank has hit a new 52-week low amid significant volatility, with a notable decline in profit and an increase in non-performing assets. Despite a strong capital adequacy ratio and growth in net interest income, the stock's performance has lagged behind its sector and the broader market.

Read More

Suryoday Small Finance Bank Faces Significant Volatility Amid Declining Performance Metrics

2025-03-11 09:51:34Suryoday Small Finance Bank has faced notable volatility, hitting a new 52-week low and experiencing a significant decline over the past year. The bank's financial metrics indicate a high Capital Adequacy Ratio, but it reported a substantial drop in profit and a rise in gross NPA, alongside decreased institutional investor participation.

Read More

Suryoday Small Finance Bank Hits 52-Week Low Amid Broader Market Decline

2025-03-04 10:37:53Suryoday Small Finance Bank has reached a new 52-week low, continuing a five-day decline. The stock is trading below key moving averages, while the broader market, represented by the Sensex, has also opened lower. Despite recent challenges, the bank shows strong capital adequacy and healthy long-term growth metrics.

Read More

Suryoday Small Finance Bank Faces Continued Decline Amid Market Volatility

2025-03-03 09:37:56Suryoday Small Finance Bank has faced notable volatility, hitting a new 52-week low of Rs. 108. The stock has underperformed its sector and declined significantly over the past year, contrasting sharply with broader market trends. It is currently trading below key moving averages, indicating a challenging market position.

Read More

Suryoday Small Finance Bank Faces Financial Challenges Amidst Strong Capital Position

2025-02-19 19:05:58Suryoday Small Finance Bank has experienced an evaluation adjustment, highlighting a shift in its financial standing amid a challenging quarter. The bank reported a decline in profit after tax and an increase in gross non-performing assets, while maintaining a strong capital adequacy ratio and demonstrating long-term growth in net interest income and profit.

Read More

Suryoday Small Finance Bank Shows Volatility Amid Broader Market Trends in February 2025

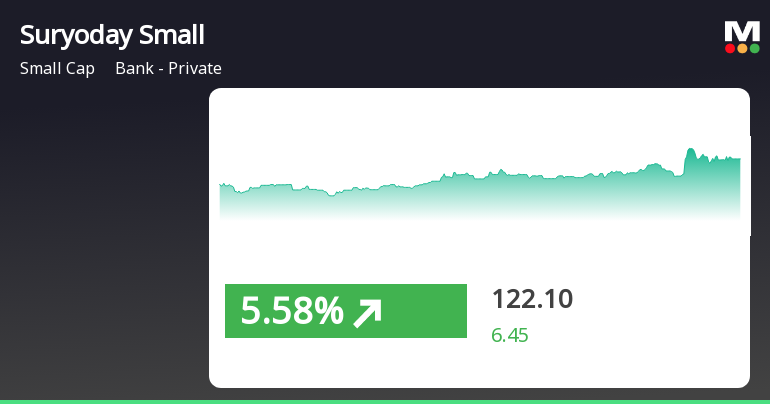

2025-02-14 15:05:24Suryoday Small Finance Bank experienced notable trading activity, gaining 7.35% on February 14, 2025, and outperforming its sector. The stock has shown a consistent upward trend over three days, despite facing challenges over the past month, indicating recent volatility in its performance relative to broader market trends.

Read More

Suryoday Small Finance Bank Hits 52-Week Low Amid Ongoing Downward Trend

2025-02-12 09:38:21Suryoday Small Finance Bank has reached a new 52-week low, continuing a downward trend with a notable decline over the past four days. Its one-year performance shows a significant drop, contrasting with the overall market gains, while the stock trades below multiple moving averages, indicating ongoing challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEPlease find attached herewith Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025.

Disclosure Under Regulation 30 Read With Schedule III Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 And Regulation 8 Read With Schedule A Of The SEBI (Prohibition Of Insider Trading) Regulations 2015

03-Apr-2025 | Source : BSEPlease find attached herewith Disclosure under Regulation 30 read with Schedule III of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Closure of Trading Window

29-Mar-2025 | Source : BSEIntimation of Closure of Trading Window for dealing in securities of the Bank in terms of the SEBI (Prohibition of Insider Trading) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available