Ultramarine & Pigments Adjusts Valuation Amid Competitive Industry Landscape

2025-03-28 08:00:12Ultramarine & Pigments, a small-cap player in the dyes and pigments industry, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 20.94 and a price-to-book value of 1.33, indicating its current market valuation relative to its book value. The EV to EBIT stands at 17.08, while the EV to EBITDA is recorded at 13.46, suggesting a moderate valuation in terms of earnings before interest, taxes, depreciation, and amortization. In terms of profitability, Ultramarine & Pigments shows a return on capital employed (ROCE) of 6.60% and a return on equity (ROE) of 5.45%. The company also offers a dividend yield of 1.01%, which may appeal to income-focused investors. When compared to its peers, Ultramarine & Pigments presents a more favorable valuation profile than Kiri Industries and Meghmani Organics, both of which are categorized as risky. However, it lags behind Vidhi...

Read MoreUltramarine & Pigments Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-19 08:00:10Ultramarine & Pigments, a small-cap player in the dyes and pigments industry, has recently undergone a valuation adjustment reflecting its financial metrics and market position. The company currently reports a price-to-earnings (PE) ratio of 19.13 and a price-to-book value of 1.22, indicating a competitive stance within its sector. Its enterprise value to EBITDA stands at 12.33, while the PEG ratio is noted at 0.98, suggesting a favorable growth outlook relative to its earnings. In terms of performance, Ultramarine & Pigments has experienced varied returns over different periods. Over the past year, the stock has returned 32.92%, significantly outperforming the Sensex, which returned 3.51%. However, year-to-date, the company has seen a decline of 15.64%, contrasting with the Sensex's modest drop of 3.63%. When compared to its peers, Ultramarine & Pigments maintains a stronger valuation profile against co...

Read MoreUltramarine & Pigments Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-05 08:00:36Ultramarine & Pigments, a small-cap player in the Dyes & Pigments industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 441.30, slightly above the previous close of 438.95. Over the past year, Ultramarine & Pigments has demonstrated a notable return of 11.89%, significantly outperforming the Sensex, which recorded a return of -1.19% during the same period. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a definitive signal on a monthly basis. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly evaluations. Daily moving averages are currently bearish, while the KST shows a bearish trend weekly but a bullish outlook month...

Read MoreUltramarine & Pigments Shows Resilience Amid Market Volatility and Industry Trends

2025-03-04 18:00:16Ultramarine & Pigments Ltd, a small-cap player in the Dyes & Pigments industry, has shown notable activity today, reflecting its ongoing market dynamics. The company currently holds a market capitalization of Rs 1,282.00 crore and has a price-to-earnings (P/E) ratio of 18.71, which is significantly lower than the industry average of 28.25. Over the past year, Ultramarine & Pigments has outperformed the Sensex, delivering a return of 11.89% compared to the index's decline of 1.19%. However, recent performance indicates some volatility, with a 0.54% increase today, while the Sensex fell by 0.13%. In the last week, the stock has decreased by 2.58%, slightly underperforming the Sensex's drop of 2.16%. Looking at longer-term trends, Ultramarine & Pigments has demonstrated resilience, with a remarkable 151.81% increase over the past five years, compared to the Sensex's 90.03%. Despite some short-term fluctuatio...

Read More

Ultramarine & Pigments Reports Strong Q3 Performance Amid Long-Term Growth Concerns

2025-02-27 18:47:20Ultramarine & Pigments, a small-cap company in the Dyes & Pigments sector, recently adjusted its evaluation following a strong third-quarter performance for FY24-25. Key metrics included a record operating profit to interest ratio and significant net sales, although long-term growth prospects appear limited amid a mildly bearish technical outlook.

Read More

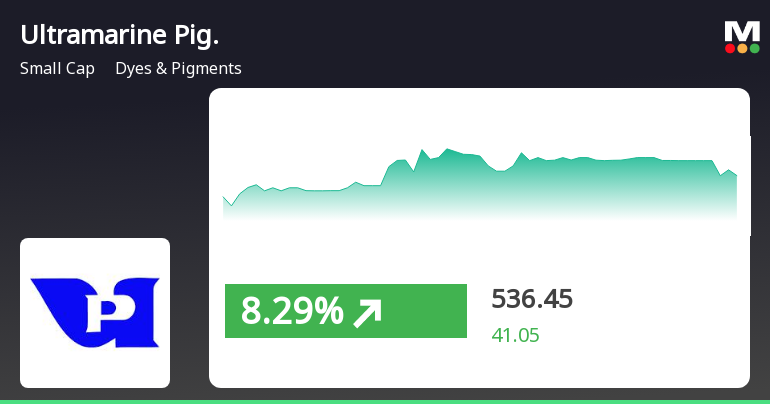

Ultramarine & Pigments Shows Resilience Amidst Mixed Performance in Dyes Sector

2025-02-19 10:45:16Ultramarine & Pigments, a small-cap company in the Dyes & Pigments sector, experienced a notable gain today, reversing two days of decline. Despite this uptick, the stock remains below key moving averages and has seen a decline over the past month, reflecting the sector's overall mixed performance.

Read More

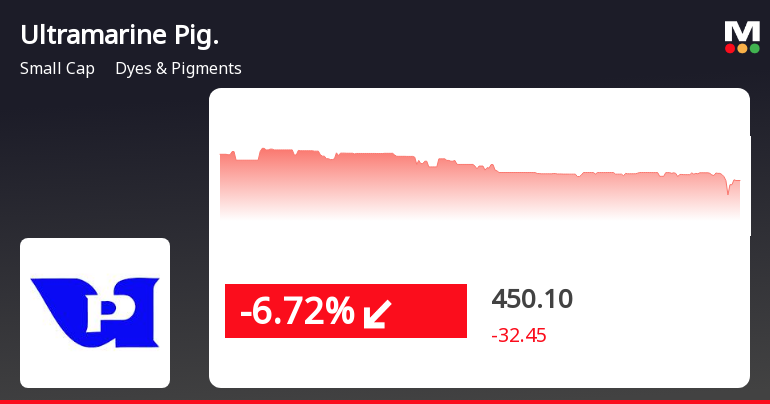

Ultramarine & Pigments Faces Significant Stock Volatility Amid Broader Market Stability

2025-02-18 15:35:12Ultramarine & Pigments, a small-cap company in the Dyes & Pigments sector, has faced notable stock volatility, experiencing consecutive losses and a significant decline over the past month. The stock is trading below key moving averages, indicating a bearish trend, contrasting sharply with the broader market performance.

Read More

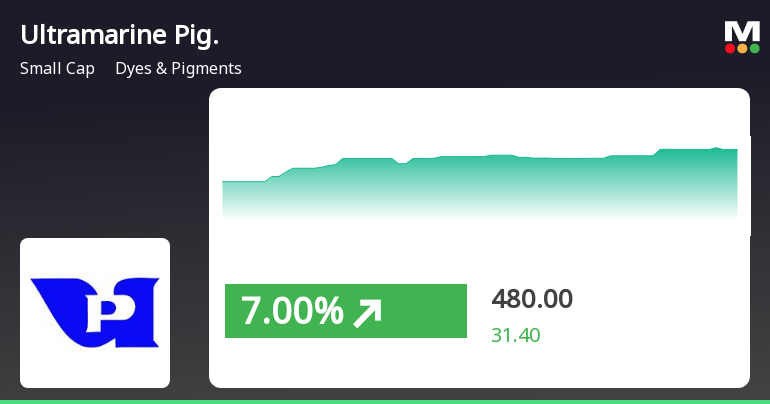

Ultramarine & Pigments Shows Strong Momentum Amid Broader Market Decline

2025-02-10 09:50:14Ultramarine & Pigments, a small-cap company in the Dyes & Pigments sector, has experienced notable stock performance, significantly outperforming its industry and the broader market. The stock has shown a strong upward trend over the past week and month, trading above key moving averages, indicating robust momentum.

Read More

Ultramarine & Pigments Reports Strong Q4 Results Amid Rising Interest Costs

2025-02-08 09:23:04Ultramarine & Pigments has announced its financial results for the quarter ending December 2024, showcasing significant growth in key metrics. The company reported a notable increase in Profit Before Tax and Profit After Tax, alongside a rise in net sales and operating profit, reflecting improved operational efficiency.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

04-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Ultramarine & Pigments Ltd- |

| 2 | CIN NO. | L24224MH1960PLC011856 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 26.78 |

| 4 | Highest Credit Rating during the previous FY | A+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | ICRA LIMITED |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary

EmailId: cs@ultramarinepigments.net

Designation: Chief Financial Officer

EmailId: finance@ultramarinepigments.net

Date: 04/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEEnclosed certificate under Reg 74(5) of SEBI (DP) Regulation 2018 from the RTA of the company for the quarter ended 31st March 2025

Closure of Trading Window

27-Mar-2025 | Source : BSETrading window will remain closed from 1st April 2025 in connection with audited financial results for the year ending 31st March 2025

Corporate Actions

No Upcoming Board Meetings

Ultramarine & Pigments Ltd has declared 250% dividend, ex-date: 18 Jul 24

No Splits history available

No Bonus history available

No Rights history available