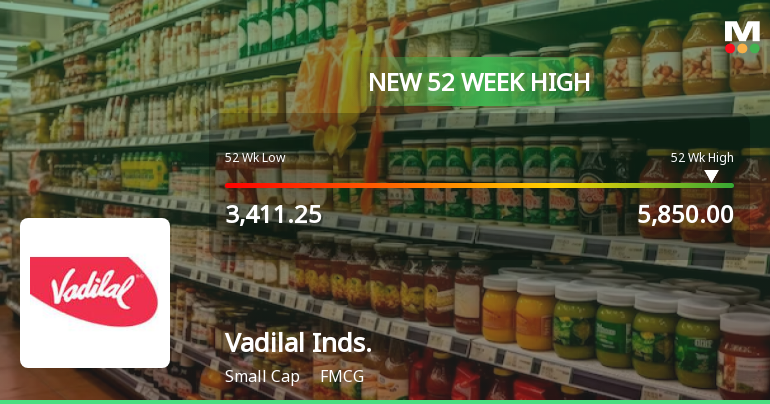

Vadilal Industries Achieves 52-Week High Amid Strong Small-Cap Market Performance

2025-04-03 14:35:53Vadilal Industries' stock reached a new 52-week high of Rs. 5850, following a strong three-day performance with a notable gain. The stock traded above key moving averages, reflecting positive trends. In the broader market, small-cap stocks led gains, while the Sensex showed resilience despite initial declines.

Read More

Vadilal Industries Reaches All-Time High Amid Strong Market Performance Trends

2025-04-03 14:31:09Vadilal Industries, a small-cap FMCG company, has shown notable trading activity, nearing its 52-week high. Despite a slight decline today, the stock remains above key moving averages. Over the past month, it has surged significantly, outperforming the Sensex and demonstrating impressive long-term returns.

Read MoreVadilal Industries Shows Bullish Technical Trends Amid Strong Market Performance

2025-04-03 08:05:05Vadilal Industries, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 5,691.80, showing a notable increase from the previous close of 5,205.00. Over the past week, the stock reached a high of 5,810.00, while the 52-week range has been between 3,411.25 and 5,810.00. The technical summary indicates a predominantly bullish sentiment across various indicators. The MACD and Dow Theory both reflect bullish trends on both weekly and monthly scales. Additionally, the Bollinger Bands and On-Balance Volume (OBV) also support this positive outlook. However, the Relative Strength Index (RSI) shows a mixed signal, with a bearish indication on the monthly timeframe. In terms of performance, Vadilal Industries has significantly outperformed the Sensex across multiple timeframes. Over the past week, the stock retur...

Read MoreVadilal Industries Adjusts Valuation Grade Amid Strong Profitability Metrics and Market Positioning

2025-04-03 08:00:42Vadilal Industries, a small-cap player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 26.23, while its price-to-book value is noted at 6.22. Other key metrics include an EV to EBIT ratio of 19.88 and an EV to EBITDA ratio of 16.59, indicating its operational efficiency. The company's return on capital employed (ROCE) is a notable 30.20%, and its return on equity (ROE) is recorded at 23.30%, showcasing strong profitability. Despite these positive indicators, the PEG ratio is relatively high at 4.34, suggesting that growth expectations may be priced in. In comparison to its peers, Vadilal Industries presents a competitive valuation landscape. Heritage Foods and Gopal Snacks are also positioned attractively, with varying metrics that highlight their market performance. Notably, while some peers exhibit...

Read More

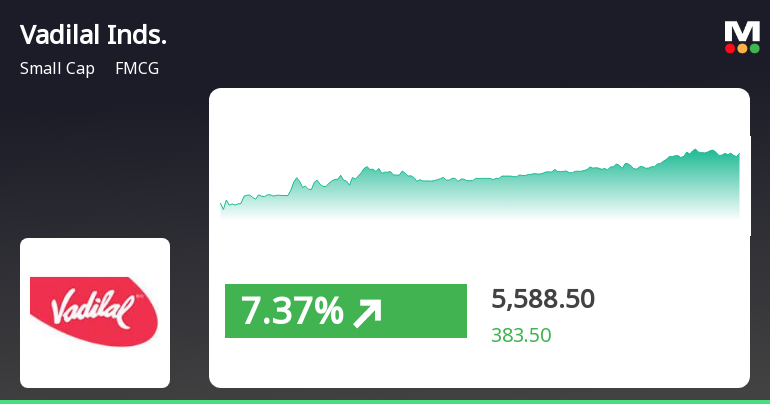

Vadilal Industries Achieves Record High Amid Strong Market Performance and Sector Outperformance

2025-04-02 12:05:19Vadilal Industries, a small-cap FMCG company, achieved a new all-time high of Rs. 5579, reflecting strong performance with a notable 20.83% return over two days. The stock is trading above key moving averages, while the broader market, represented by the Sensex, also shows positive momentum.

Read More

Vadilal Industries Achieves 52-Week High Amid Strong Market Performance

2025-04-02 10:36:46Vadilal Industries has achieved a new 52-week high of Rs. 5472.15, following a notable 16.47% increase over two days. The stock outperformed its sector and is trading above key moving averages, reflecting a strong upward trend. Over the past year, it has delivered a return of 20.62%.

Read More

Vadilal Industries Reaches All-Time High Amid Strong Market Momentum and Impressive Returns

2025-04-02 10:06:01Vadilal Industries has reached an all-time high, trading close to its 52-week peak and outperforming its sector. The stock has shown significant gains over the past month and year-to-date, with impressive long-term performance metrics, reflecting strong market momentum and consistent upward trends across various moving averages.

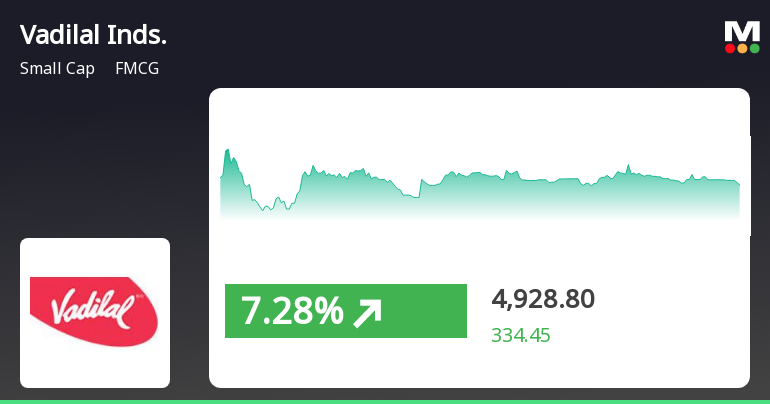

Read MoreVadilal Industries Shows Mixed Technical Trends Amidst Significant Stock Volatility

2025-04-02 08:07:31Vadilal Industries, a small-cap player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price has shown notable fluctuations, with a current price of 5,205.00, up from a previous close of 4,594.35. Over the past year, the stock has reached a high of 5,443.00 and a low of 3,411.25, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bullish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates a bearish trend monthly. Bollinger Bands and daily moving averages suggest a bullish sentiment, while the KST reflects a similar pattern on a weekly basis but turns mildly bearish monthly. When comparing the company's performance to the Sensex, Vadilal Industries has demonstrated impressive returns. Over the pa...

Read More

Vadilal Industries Outperforms Market with Significant Stock Gains Amid Declining Sensex

2025-04-01 11:40:29Vadilal Industries, a small-cap FMCG company, experienced notable stock activity on April 1, 2025, with a significant intraday high. Despite a declining market, the stock has shown impressive growth over the past month and five years, outperforming the broader market indices.

Read MoreShareholder Meeting / Postal Ballot-Notice of Postal Ballot

09-Apr-2025 | Source : BSEPostal Ballot Notice Vadilal Industries Limited

Corrigendum - Correction Of Typographical Errors In Disclosure Dated March 29 2025Under Regulation 30 And Regulation 30A Read With Relevant Clauses Of Paragraph A Of Part A Of Schedule III Of The Securities And Exchange Board Of India (Listing Obligation

09-Apr-2025 | Source : BSECorrigendum- Correction of typographical error.

Announcement Under Regulation 30

30-Mar-2025 | Source : BSEAnnouncement under Reg 30

Corporate Actions

No Upcoming Board Meetings

Vadilal Industries Ltd has declared 15% dividend, ex-date: 19 Sep 24

No Splits history available

No Bonus history available

No Rights history available