Vaibhav Global Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-04-02 08:00:19Vaibhav Global, a small-cap player in the lifestyle industry, has recently undergone a valuation adjustment, reflecting its financial performance and market position. The company currently boasts a price-to-earnings (P/E) ratio of 26.27 and a price-to-book value of 3.00, indicating a solid valuation framework. Its enterprise value to EBITDA stands at 13.39, while the enterprise value to sales ratio is 1.13, showcasing its operational efficiency. In terms of profitability, Vaibhav Global reports a return on capital employed (ROCE) of 13.25% and a return on equity (ROE) of 10.32%. The company also offers a dividend yield of 1.98%, which adds to its appeal among investors seeking income. When compared to its peers, Vaibhav Global's valuation metrics position it favorably against companies like Siyaram Silk and Timex Group, which exhibit varying levels of valuation and performance. Notably, while some peers a...

Read More

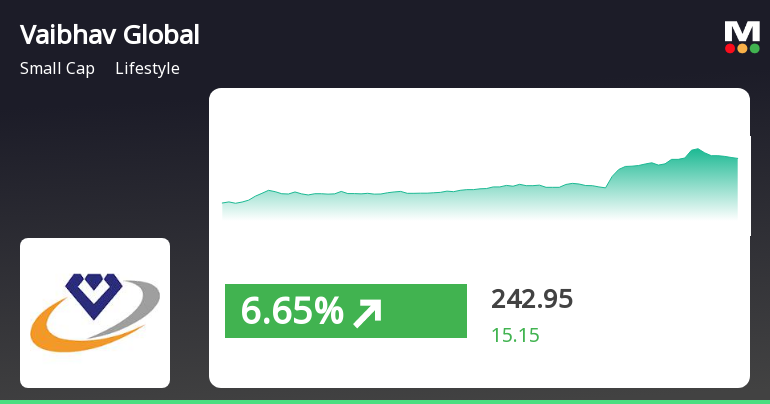

Vaibhav Global Shows Strong Short-Term Gains Amid Broader Market Volatility

2025-03-21 10:30:21Vaibhav Global, a small-cap lifestyle company, has experienced notable trading activity, outperforming the broader market. The stock has shown a strong upward trend over the past four days, although its longer-term performance indicates significant volatility. The overall market is also seeing gains, particularly in small-cap stocks.

Read More

Vaibhav Global Faces Market Challenges Amid Declining Stock Performance and Low Debt Levels

2025-03-17 12:05:12Vaibhav Global has faced significant stock volatility, reaching a new 52-week low and experiencing a notable decline over recent days. The company has underperformed its sector and recorded a substantial yearly drop. Despite low debt levels and strong quarterly sales, institutional interest has waned, highlighting a challenging market position.

Read More

Vaibhav Global Faces Market Challenges Amid Declining Stock Performance and Investor Participation

2025-03-13 15:05:13Vaibhav Global has reached a new 52-week low, reflecting a significant decline in its stock price over the past year. The company has struggled with negative growth in operating profit and reduced institutional investor participation. However, it reported strong quarterly results, showcasing record net sales and a favorable debt-to-equity ratio.

Read More

Vaibhav Global Hits New Low Amid Broader Market Challenges and Declining Performance

2025-02-28 10:05:16Vaibhav Global, a small-cap lifestyle company, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined nearly 10% over the past week and is trading below multiple moving averages, reflecting ongoing challenges in the market. Its one-year performance shows a notable decline compared to the Sensex.

Read More

Vaibhav Global Faces Significant Stock Decline Amid Broader Market Gains

2025-02-27 09:35:12Vaibhav Global, a small-cap lifestyle company, has hit a new 52-week low, reflecting significant volatility and a 47.18% decline over the past year. The stock has underperformed its sector and is currently trading below multiple moving averages, indicating a bearish trend in its performance.

Read MoreVaibhav Global Adjusts Valuation Grade Amid Competitive Lifestyle Sector Landscape

2025-02-27 08:00:14Vaibhav Global, a small-cap player in the lifestyle industry, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings (PE) ratio stands at 27.27, while its price-to-book value is recorded at 3.11. Additionally, the enterprise value to EBITDA ratio is 13.90, and the EV to sales ratio is 1.17. The company also boasts a dividend yield of 1.91% and a return on capital employed (ROCE) of 13.25%, alongside a return on equity (ROE) of 10.32%. In comparison to its peers, Vaibhav Global's valuation appears more favorable, particularly when contrasted with companies like Timex Group, which has a significantly higher PE ratio of 57.15, and Restaurant Brand, which is currently loss-making. Other competitors, such as Siyaram Silk and Monte Carlo Fashion, have also been noted for their attractive valuations, yet Vaibhav Global maintains...

Read More

Vaibhav Global Faces Continued Volatility Amid Broader Market Challenges

2025-02-25 10:35:12Vaibhav Global, a small-cap lifestyle company, has hit a new 52-week low, continuing a three-day decline totaling 5.02%. The stock has underperformed its sector and has seen a significant year-over-year drop of 46.25%, contrasting with the Sensex's modest gain. It is trading below key moving averages.

Read More

Vaibhav Global Faces Significant Volatility Amidst Broader Market Challenges

2025-02-24 09:35:15Vaibhav Global, a small-cap lifestyle company, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined consecutively over two days and is trading below its moving averages. Over the past year, it has faced challenges, contrasting with the Sensex's gains.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the Securities and Exchange Board of India (Depositories and participants) Regulations 2018

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

03-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Brett Enterprises Pvt Ltd & PACs

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEVaibhav Global Limited Receives Combined ESG Rating of 72 (Strong) from ICRA

Corporate Actions

No Upcoming Board Meetings

Vaibhav Global Ltd has declared 75% dividend, ex-date: 07 Feb 25

Vaibhav Global Ltd has announced 2:10 stock split, ex-date: 07 May 21

No Bonus history available

No Rights history available