VST Industries Faces Continued Volatility Amid Broader Market Decline and Profit Challenges

2025-03-04 09:56:45VST Industries has hit a new 52-week low, continuing a downward trend with a notable decline over the past four days. The company's operating profit has decreased annually, while it maintains a high return on equity and a low debt-to-equity ratio, despite concerns about long-term growth.

Read More

VST Industries Faces Significant Stock Volatility Amidst Competitive Market Challenges

2025-03-03 09:36:06VST Industries has reached a new 52-week low, reflecting significant volatility and a notable performance dip compared to its sector. The stock has declined consecutively over three days and is trading below key moving averages, indicating ongoing challenges. Despite a high dividend yield, its one-year performance shows a substantial decline.

Read MoreVST Industries Adjusts Valuation Amidst Challenging Market Performance and Competitive Pressures

2025-03-01 08:00:21VST Industries, a small-cap player in the Cigarettes/Tobacco industry, has recently undergone a valuation adjustment, reflecting its financial performance metrics. The company currently exhibits a price-to-earnings (P/E) ratio of 17.66 and a price-to-book value of 3.79. Its enterprise value to EBITDA stands at 13.64, while the enterprise value to EBIT is recorded at 15.88. Notably, VST Industries showcases a robust dividend yield of 5.40%, alongside a return on capital employed (ROCE) of 26.36% and a return on equity (ROE) of 21.44%. In terms of market performance, VST Industries has faced challenges, with a year-to-date return of -24.61%, significantly lagging behind the Sensex, which has returned -6.32% over the same period. Over the past year, the stock has declined by 23.93%, contrasting with the Sensex's modest gain of 1.24%. Additionally, the company's performance over longer periods, such as three a...

Read More

VST Industries Hits New Low Amid Sustained Downward Trend and Market Challenges

2025-02-28 09:36:37VST Industries has reached a new 52-week low, reflecting a significant decline in its stock performance. The company has underperformed its sector and is trading below various moving averages. Despite a high dividend yield, the stock has decreased notably over the past year, contrasting with broader market gains.

Read More

VST Industries Faces Significant Volatility Amidst Broader Market Trends and High Dividend Yield

2025-02-27 10:05:30VST Industries, a small-cap in the Cigarettes/Tobacco sector, reached a new 52-week low today, underperforming its industry. The stock has struggled over the past year, declining significantly while the broader market has gained. However, it offers a high dividend yield, attracting income-focused investors.

Read More

VST Industries Faces Significant Stock Volatility Amidst Broader Market Trends

2025-02-24 09:35:35VST Industries has reached a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has declined consecutively over three days and is trading below various moving averages. Over the past year, it has faced challenges, contrasting with the Sensex, while maintaining a high dividend yield.

Read More

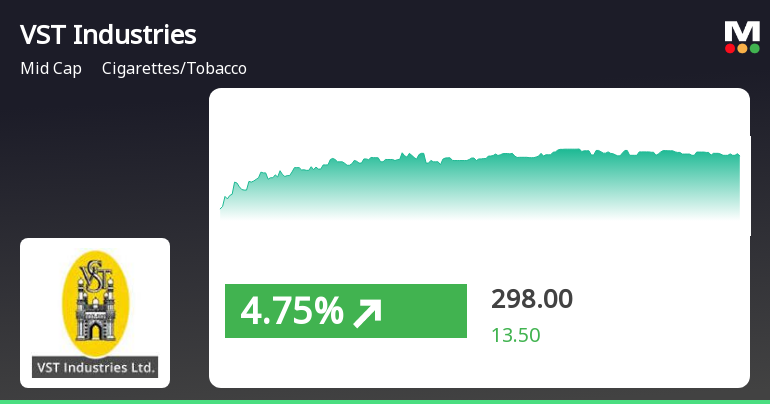

VST Industries Experiences Significant Stock Recovery Amidst Recent Volatility

2025-02-19 12:15:28VST Industries experienced a notable uptick on February 19, 2025, after seven days of decline, outperforming its sector. The stock reached an intraday high, although it remains below key moving averages. With a high dividend yield, it reflects recent volatility amid broader market trends.

Read More

VST Industries Faces Significant Stock Volatility Amidst Competitive Market Challenges

2025-02-18 11:54:01VST Industries has faced significant volatility, reaching a new 52-week low and trailing its sector. The stock has seen consecutive weekly losses and is trading below multiple moving averages, indicating a bearish trend. Despite this, it offers a high dividend yield, appealing to income-focused investors.

Read More

VST Industries Approaches 52-Week Low Amidst Sector Outperformance and Bearish Trends

2025-02-17 09:37:39VST Industries, a midcap player in the Cigarettes/Tobacco sector, is nearing a 52-week low while showing some signs of recovery after five days of decline. The stock remains below key moving averages but offers a high dividend yield, attracting income-focused investors amid a challenging year.

Read MoreClosure of Trading Window

28-Mar-2025 | Source : BSEClosure of Trading Window

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

12-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for SBI Mutual Fund

Board Meeting Outcome for Outcome Of The Board Meeting

07-Feb-2025 | Source : BSEOutcome of the Board Meeting

Corporate Actions

No Upcoming Board Meetings

VST Industries Ltd has declared 1500% dividend, ex-date: 14 Jun 24

No Splits history available

VST Industries Ltd has announced 10:1 bonus issue, ex-date: 06 Sep 24

No Rights history available