Xchanging Solutions Adjusts Valuation Amidst Competitive BPO/ITeS Sector Dynamics

2025-04-02 08:02:20Xchanging Solutions, a microcap player in the BPO/ITeS sector, has recently undergone a valuation adjustment. The company's current price stands at 88.63, reflecting a slight increase from the previous close of 86.25. Over the past year, Xchanging Solutions has faced challenges, with a stock return of -26.63%, contrasting sharply with a positive return of 2.72% for the Sensex during the same period. Key financial metrics for Xchanging Solutions include a PE ratio of 20.87 and an EV to EBITDA ratio of 17.49. The company also boasts a robust return on capital employed (ROCE) of 30.12% and a dividend yield of 4.51%. However, when compared to its peers, Xchanging Solutions presents a mixed picture. For instance, IRIS Business and ERP Soft Systems are positioned with significantly higher PE ratios, indicating a different valuation landscape. Intrasoft Technologies and Riddhi Corporate show more attractive metri...

Read More

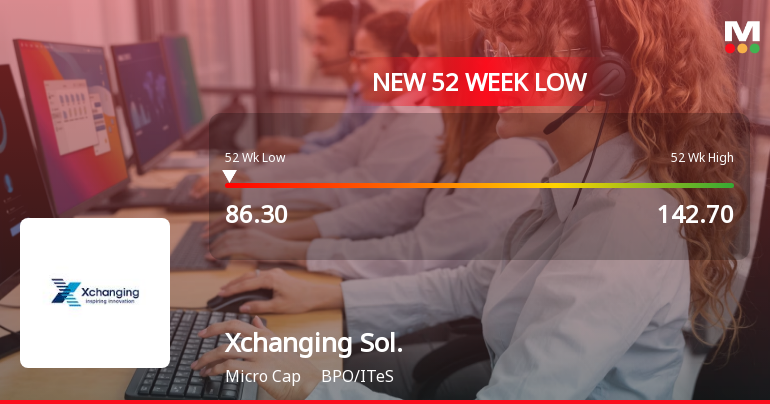

Xchanging Solutions Hits 52-Week Low Amid Ongoing Decline and Mixed Financial Performance

2025-03-28 15:46:02Xchanging Solutions, a microcap in the BPO/ITeS sector, has hit a new 52-week low, continuing a four-day decline. Over the past year, the company has faced challenges, with a significant drop in stock value. Despite strong quarterly results and a high dividend yield, long-term growth prospects appear uncertain.

Read More

Xchanging Solutions Hits 52-Week Low Amidst Mixed Financial Performance Indicators

2025-03-28 15:46:00Xchanging Solutions, a microcap in the BPO/ITeS sector, reached a new 52-week low amid a four-day decline. Despite a challenging year with a 23.81% drop, the company reported record quarterly net sales and a strong operating profit margin. However, long-term growth prospects remain uncertain.

Read More

Xchanging Solutions Hits 52-Week Low Amidst Ongoing Financial Challenges and Mixed Performance

2025-03-28 15:46:00Xchanging Solutions, a microcap in the BPO/ITeS sector, has reached a 52-week low, continuing a four-day decline. Over the past year, the company has faced challenges, with a significant drop in stock value. Despite reporting strong quarterly net sales and a high dividend yield, long-term growth prospects appear uncertain.

Read MoreXchanging Solutions Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-03-26 08:00:42Xchanging Solutions, a microcap player in the BPO/ITeS sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 89.75, down from a previous close of 91.90, with a 52-week high of 142.70 and a low of 85.51. Key financial metrics reveal a PE ratio of 21.13 and a price-to-book value of 3.02, indicating a moderate valuation relative to its assets. The company also shows a solid dividend yield of 4.46% and a return on capital employed (ROCE) of 30.12%, suggesting effective capital utilization. However, its year-to-date return is down by 19.69%, contrasting with a slight gain of 0.16% in the broader Sensex index. In comparison to its peers, Xchanging Solutions presents a more favorable valuation profile, particularly when juxtaposed with companies like IRIS Business and ERP Soft Systems, which exhibit significantly higher PE rati...

Read More

Xchanging Solutions Faces Challenges Amidst Mixed Financial Performance and Recent Stock Decline

2025-03-19 09:50:28Xchanging Solutions, a microcap in the BPO/ITeS sector, reached a new 52-week low amid a six-day decline, despite a brief intraday recovery. The stock has underperformed over the past year, with a significant drop in net sales and operating profit, raising concerns about its long-term growth prospects.

Read More

Xchanging Solutions Hits 52-Week Low Amid Mixed Financial Performance and Market Trends

2025-03-19 09:50:22Xchanging Solutions, a microcap in the BPO/ITeS sector, reached a new 52-week low today, reflecting a significant decline over the past year. Despite a slight recovery, the stock remains below key moving averages. The company reported strong quarterly net sales and a favorable debt-to-equity ratio, but faces long-term growth challenges.

Read More

Xchanging Solutions Hits 52-Week Low Amidst Ongoing Bearish Trend and Declining Sales

2025-03-19 09:50:20Xchanging Solutions, a microcap in the BPO/ITeS sector, reached a new 52-week low amid a six-day losing streak, despite a brief intraday gain. The stock has declined 24.94% over the past year, with poor long-term growth metrics, though it offers a high dividend yield and recent strong quarterly results.

Read More

Xchanging Solutions Faces Continued Volatility Amid Broader Market Resilience

2025-03-18 15:07:25Xchanging Solutions, a microcap in the BPO/ITeS sector, has hit a new 52-week low and underperformed its sector significantly. Despite a high dividend yield and low debt-to-equity ratio, the company faces challenges with declining net sales and operating profit over the past five years, contrasting with broader market gains.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 is enclosed.

Closure of Trading Window

26-Mar-2025 | Source : BSEThis is to inform you that the trading window for dealing in securities of Xchanging Solutions Limited will remain closed from April 01 2025 till 48 hours after the declaration of financial results for the quarter and period ended March 31 2025.

Announcement Under Regulation 30(5) Of LODR

03-Mar-2025 | Source : BSEWe hereby submit the updated list of Key Managerial Personnel as required under Regulation 30(5) of SEBI LODR Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Xchanging Solutions Ltd has declared 20% dividend, ex-date: 14 Jun 24

No Splits history available

No Bonus history available

No Rights history available