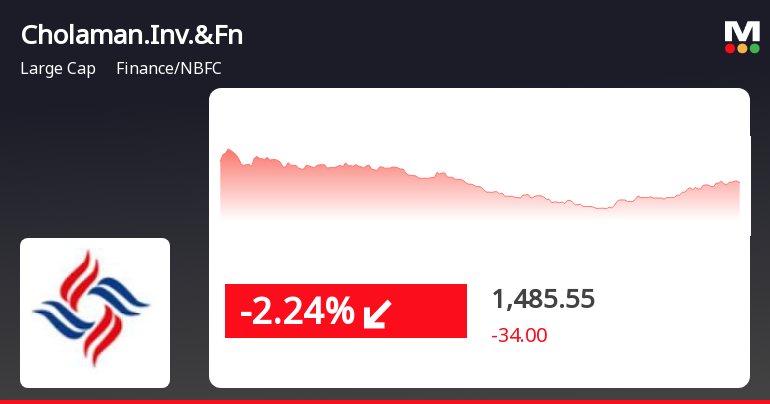

Cholamandalam Investment Faces Short-Term Decline Amid Broader Market Volatility

2025-04-01 11:40:44Cholamandalam Investment & Finance Company has faced a decline amid a broader market slump, with consecutive losses over two days. However, the company has shown strong long-term performance, significantly outperforming the Sensex over various periods, and remains above key moving averages despite recent volatility.

Read MoreCholamandalam Investment Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-04-01 08:03:02Cholamandalam Investment & Finance Company, a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock is currently priced at 1519.55, slightly down from the previous close of 1528.00, with a 52-week high of 1,650.00 and a low of 1,099.05. In terms of technical indicators, the weekly MACD shows a bullish trend, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) presents a bearish signal on a weekly basis, with no significant signal on a monthly scale. Bollinger Bands suggest a mildly bullish outlook weekly and bullish monthly, while moving averages indicate a bullish trend daily. The KST reflects a bullish trend weekly and mildly bearish monthly, and Dow Theory supports a mildly bullish stance across both timeframes. When compari...

Read MoreCholamandalam Investment & Finance Company Shows Strong Performance Amid Market Trends

2025-03-28 18:00:06Cholamandalam Investment & Finance Company, a prominent player in the finance and non-banking financial company (NBFC) sector, has shown significant performance metrics over the past year. With a market capitalization of Rs 1,27,403.00 crore, the company has outperformed the Sensex, achieving a remarkable 31.38% increase compared to the index's 5.11% during the same period. Despite a slight decline of 0.55% today, Cholamandalam's one-month performance remains strong at 8.50%, surpassing the Sensex's 5.76%. Over the last three months, the company has demonstrated resilience with a 27.32% gain, while the Sensex has faced a decline of 1.63%. Year-to-date, Cholamandalam has achieved a 28.06% increase, contrasting with the Sensex's negative performance of -0.93%. The company's price-to-earnings (P/E) ratio stands at 31.41, significantly higher than the industry average of 8.62, indicating robust earnings relat...

Read MoreCholamandalam Investment Shows Strong Trading Activity Amid Sector Underperformance

2025-03-24 12:00:05Cholamandalam Investment & Finance Company Ltd (CHOLAFIN) has emerged as one of the most active equities today, with a total traded volume of 2,866,447 shares and a total traded value of approximately Rs 44.74 crore. The stock opened at Rs 1,554.85 and reached an intraday high of Rs 1,580, reflecting a 2.7% increase during the trading session. As of the latest update, the last traded price stands at Rs 1,550.10. Despite this activity, Cholamandalam's performance today has underperformed its sector by 0.43%. However, the stock has shown resilience, gaining 4.08% over the past two days. It is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a positive trend in its price movement. Investor participation has also seen a rise, with a delivery volume of 111,000 shares on March 21, which is 3.35% higher than the 5-day average delivery volume. The stock's liquidi...

Read More

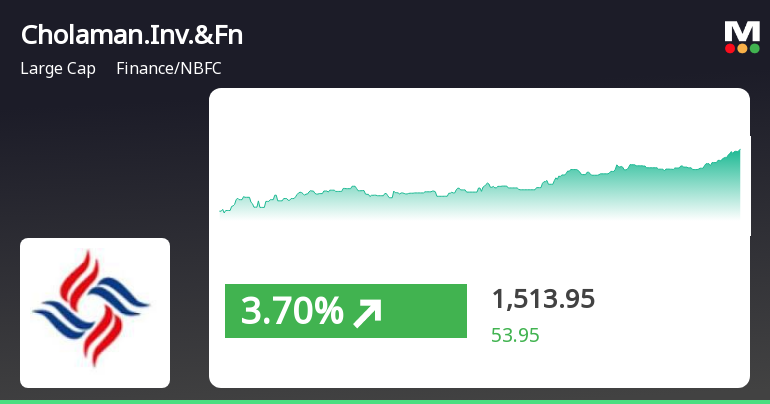

Cholamandalam Investment Shows Strong Reversal and Outperformance in Financial Sector

2025-03-21 10:35:28Cholamandalam Investment & Finance Company has experienced a notable rebound, reversing two days of decline with a significant intraday high. The stock has consistently outperformed its sector and the broader market, showcasing impressive returns over various time frames, highlighting its strong position in the finance and NBFC sector.

Read More

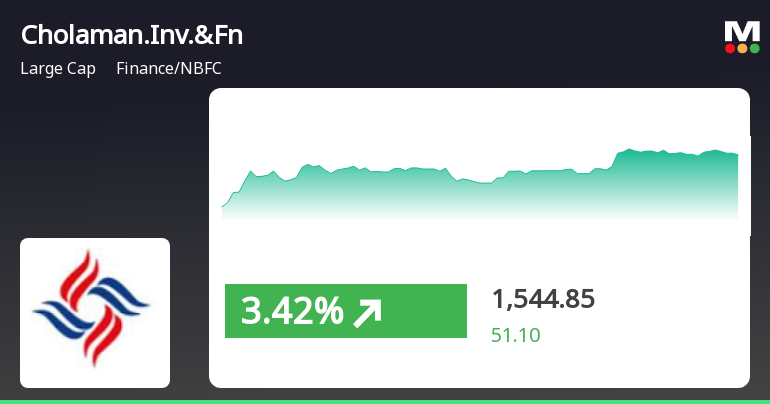

Cholamandalam Investment Shows Strong Performance Amid Broader Market Gains

2025-03-18 15:01:00Cholamandalam Investment & Finance Company has demonstrated strong performance, gaining 3.42% on March 18, 2025, and outperforming its sector. The stock has shown consecutive gains over two days and is trading above multiple moving averages, reflecting a positive trend. Year-to-date, it has increased by 27.41%.

Read MoreCholamandalam Investment Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-13 08:02:13Cholamandalam Investment & Finance Company, a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1450.70, slightly down from the previous close of 1455.85. Over the past year, Cholamandalam has demonstrated robust performance, with a notable return of 36.21%, significantly outpacing the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments, suggesting a neutral momentum. Additionally, Bollinger Bands reflect a mildly bullish stance on a weekly basis and bullish on a monthly basis, indicating some volatility in price movement...

Read MoreCholamandalam Investment Shows Mixed Technical Trends Amid Strong Historical Performance

2025-03-13 08:02:13Cholamandalam Investment & Finance Company, a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1450.70, slightly down from the previous close of 1455.85. Over the past year, Cholamandalam has demonstrated robust performance, with a notable return of 36.21%, significantly outpacing the Sensex, which recorded a mere 0.49% return in the same period. In terms of technical indicators, the weekly MACD remains bullish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments, suggesting a neutral momentum. Additionally, Bollinger Bands reflect a mildly bullish stance on a weekly basis and bullish on a monthly basis, indicating some volatility in price movement...

Read MoreCholamandalam Investment Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-12 08:02:42Cholamandalam Investment & Finance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 1455.85, showing a notable increase from the previous close of 1419.80. Over the past year, Cholamandalam has demonstrated strong performance, with a return of 32.96%, significantly outpacing the Sensex, which recorded a modest gain of 0.82% during the same period. In terms of technical indicators, the weekly MACD is bullish, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands indicate bullish conditions on both weekly and monthly charts, suggesting a potential for upward movement. The daily moving averages, however, reflect a mildly bearish sentiment, indicating mixed signals in the short term. Cholamandalam's performance over various time frames highlights its res...

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment

09-Apr-2025 | Source : BSECompany confirms allotment of 50000 unsecured listed redeemable non convertible subordinated debentures

Closure of Trading Window

07-Apr-2025 | Source : BSEIntimation of Trading Window closure

Board Meeting Intimation for Intimation Of Board Meeting

07-Apr-2025 | Source : BSECholamandalam Investment And Finance Company Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 25/04/2025 inter alia to consider and approve Intimation of Board meeting scheduled on 25-Apr-2025

Corporate Actions

No Upcoming Board Meetings

Cholamandalam Investment & Finance Company Ltd has declared 65% dividend, ex-date: 07 Feb 25

Cholamandalam Investment & Finance Company Ltd has announced 2:10 stock split, ex-date: 14 Jun 19

No Bonus history available

Cholamandalam Investment & Finance Company Ltd has announced 3:8 rights issue, ex-date: 11 Sep 07