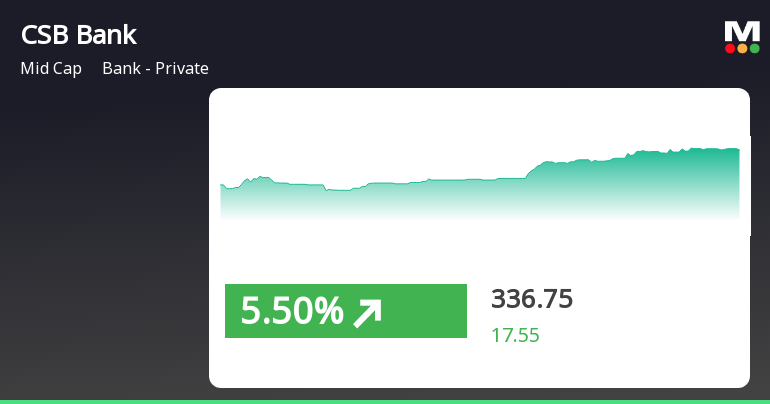

CSB Bank's Recent Gains Highlight Strong Short-Term Performance Amid Market Volatility

2025-04-03 12:05:24CSB Bank has demonstrated strong performance, gaining 5.72% on April 3, 2025, and achieving consecutive gains over two days. The stock is trading above multiple moving averages, with notable returns over the past week and month, despite a decline over the past year. The broader market remains volatile.

Read More

CSB Bank Faces Valuation Shift Amid Mixed Financial Performance and Profit Decline

2025-04-03 08:12:27CSB Bank has recently experienced a change in its valuation grade, reflecting a more balanced assessment of its financial health. Key metrics include a price-to-earnings ratio of 9.98 and a return on equity of 13.40%. The bank has faced challenges, including a decline in profit before tax and underperformance relative to market indices.

Read More

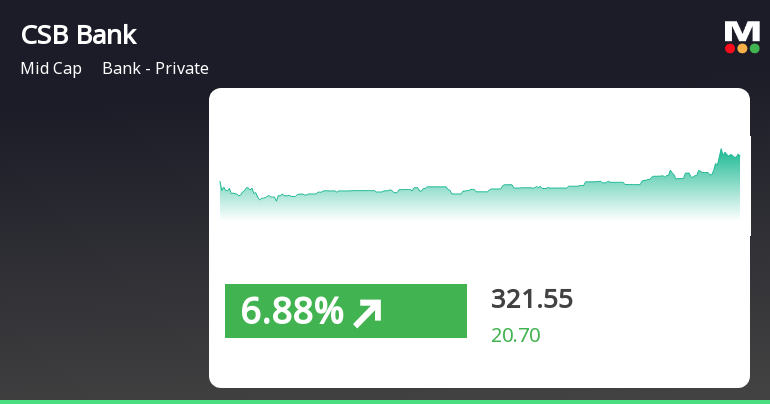

CSB Bank Outperforms Sector Amid Broader Market Gains and Positive Trends

2025-04-02 13:50:23CSB Bank's stock has experienced notable gains, outperforming its sector significantly. It is currently trading above all key moving averages, indicating a positive trend. Despite a challenging year, the bank's year-to-date performance shows a modest increase, contrasting with a slight decline in the broader market.

Read MoreCSB Bank Opens Strong with 4.49% Gain, Outperforming Sector Trends

2025-04-02 12:50:17CSB Bank, a midcap player in the private banking sector, has shown significant activity today, opening with a gain of 4.49%. The stock's performance has notably outpaced its sector, outperforming by 3.18%. During intraday trading, CSB Bank reached a high of Rs 315.65, reflecting a 4.92% increase. In terms of performance metrics, CSB Bank has delivered a 1-day return of 3.97%, compared to the Sensex's modest gain of 0.61%. Over the past month, the bank's stock has surged by 11.52%, while the Sensex has risen by 4.50%. Technical indicators present a mixed picture. The stock is currently above its 5-day, 20-day, 50-day, and 100-day moving averages, yet remains below its 200-day moving average. The MACD suggests a mildly bullish outlook on a weekly basis, while monthly indicators lean towards a bearish sentiment. Additionally, CSB Bank has a beta of 1.20, indicating that it tends to exhibit higher volatility...

Read MoreCSB Bank Adjusts Valuation Grade Amid Mixed Competitive Metrics and Market Dynamics

2025-04-01 08:00:46CSB Bank has recently undergone a valuation adjustment, reflecting its current standing in the private banking sector. The bank's price-to-earnings (PE) ratio is reported at 9.45, while its price-to-book value stands at 1.27. Notably, CSB Bank has a return on equity (ROE) of 13.40% and a return on assets (ROA) of 1.53%. The net non-performing assets (NPA) to book value ratio is recorded at 4.41. In comparison to its peers, CSB Bank's valuation metrics present a mixed picture. For instance, Karur Vysya Bank and City Union Bank are both categorized differently, with PE ratios of 8.93 and 10.73, respectively. RBL Bank, on the other hand, shows a higher PE ratio of 10.79, indicating a stronger market position among its competitors. CSB Bank's stock performance over various periods reveals a 1-month return of 7.72%, outperforming the Sensex's 5.76% return in the same timeframe. However, over the past year, CS...

Read MoreCSB Bank Adjusts Valuation Grade Amid Mixed Financial Metrics and Competitive Positioning

2025-03-25 08:01:04CSB Bank has recently undergone a valuation adjustment, reflecting its current financial standing within the private banking sector. The bank's price-to-earnings (PE) ratio stands at 9.46, while its price-to-book value is recorded at 1.27. Notably, CSB Bank has a return on equity (ROE) of 13.40% and a return on assets (ROA) of 1.53%. The net non-performing assets (NPA) to book value ratio is 4.41, indicating a moderate level of asset quality. In comparison to its peers, CSB Bank's valuation metrics present a mixed picture. For instance, Karur Vysya Bank and City Union Bank have PE ratios of 8.94 and 10.87, respectively, while RBL Bank and Ujjivan Small Finance Bank exhibit higher valuations. CSB Bank's performance over various time frames shows a 9.4% return over the past week, outperforming the Sensex, which returned 5.14% in the same period. However, its year-to-date performance reflects a decline of 3.5...

Read More

CSB Bank Adjusts Evaluation Amid Mixed Performance Indicators and Technical Trends

2025-03-20 08:09:36CSB Bank has experienced a recent evaluation adjustment, reflecting changes in its technical trends. The bank shows a mix of performance indicators, including a strong Return on Assets and Capital Adequacy Ratio, despite facing challenges in stock performance relative to market indices. The adjustment highlights the complexities of its market position.

Read MoreCSB Bank Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-20 08:03:58CSB Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 297.00, showing a notable increase from the previous close of 286.45. Over the past year, CSB Bank has faced challenges, with a return of -13.61%, contrasting with a positive return of 4.77% for the Sensex during the same period. In terms of technical indicators, the bank's MACD and KST metrics indicate a bearish stance on a weekly basis, while the monthly outlook remains mildly bearish. The Bollinger Bands and moving averages also reflect a mildly bearish trend, suggesting a cautious market sentiment. However, the On-Balance Volume (OBV) shows a bullish trend on a monthly basis, indicating some underlying strength. Despite the recent challenges, CSB Bank has demonstrated resilience over longer periods, with a three-year ret...

Read More

CSB Bank Faces Significant Volatility Amid Broader Market Gains and Strong Fundamentals

2025-03-05 09:54:18CSB Bank has faced notable volatility, reaching a new 52-week low and underperforming its sector. Despite this, the bank boasts a low Gross NPA ratio and a strong Capital Adequacy Ratio. Over the past year, its performance has been challenging compared to broader market trends.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ender March 31 2025.

Business Updates For The Financial Year Ended March 31 2025

01-Apr-2025 | Source : BSEBusiness Updates for the Financial Year ended March 31 2025

Board Meeting Intimation for Consider And Approve The Audited Financial Results Of The Bank For The Quarter And Financial Year Ending March 31 2025

28-Mar-2025 | Source : BSECSB Bank Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 28/04/2025 inter alia to consider and approve the audited financial results of the Bank for the quarter and financial year ending March 31 2025

Corporate Actions

28 Apr 2025

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available