GTPL Hathway Faces Mixed Technical Indicators Amid Market Performance Challenges

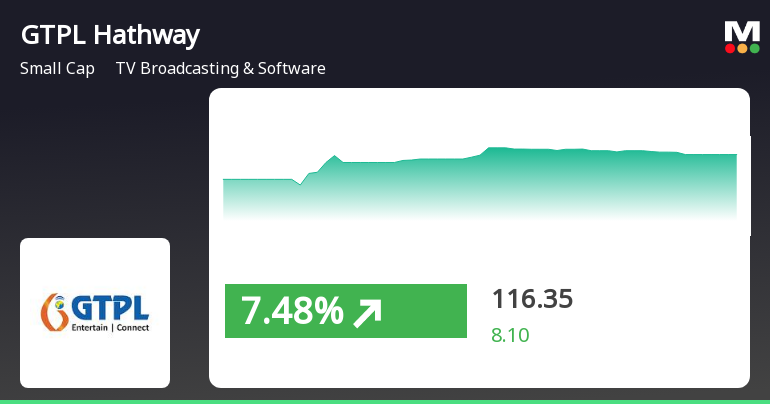

2025-04-03 08:05:52GTPL Hathway, a small-cap player in the TV Broadcasting and Software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 111.35, showing a slight increase from the previous close of 109.00. Over the past week, GTPL Hathway has demonstrated a stock return of 2.91%, contrasting with a decline of 0.87% in the Sensex, indicating a short-term outperformance. However, the company's longer-term performance reveals challenges, with a year-to-date return of -18.69% compared to a modest decline of -1.95% in the Sensex. Over the past year, GTPL Hathway has faced a significant drop of 37%, while the Sensex has gained 3.67%. This trend continues over three years, where the stock has decreased by 39.35%, while the Sensex has risen by 29.25%. In contrast, the five-year performance shows GTPL Hathway with a return of 153.07%, although this is sti...

Read More

GTPL Hathway Faces Financial Challenges Amid Declining Profitability and Market Performance

2025-04-02 08:32:35GTPL Hathway has recently experienced a score adjustment reflecting ongoing challenges in its financial performance. The company has faced declining profits and operating margins, alongside a notable contraction in operating profit over five years. Despite these issues, it maintains a low debt-to-equity ratio, offering some financial stability.

Read MoreGTPL Hathway Faces Mixed Technical Signals Amidst Market Challenges

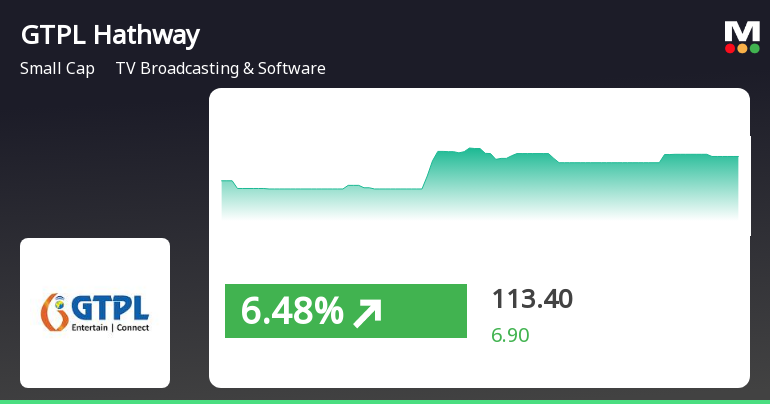

2025-04-02 08:09:04GTPL Hathway, a small-cap player in the TV Broadcasting & Software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 109.00, showing a slight increase from the previous close of 108.40. Over the past year, GTPL Hathway has faced challenges, with a significant decline of 37.61% compared to a modest gain of 2.72% in the Sensex. The technical summary indicates mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) reflects bullish sentiment in both weekly and monthly evaluations. However, Bollinger Bands and moving averages present a bearish outlook on daily metrics, suggesting volatility and potential caution. In terms of returns, GTPL Hathway's performance over different periods reveals a stark contrast wit...

Read More

GTPL Hathway Faces Technical Shift Amid Declining Profitability and Bearish Indicators

2025-03-27 08:10:52GTPL Hathway, a small-cap entity in the TV Broadcasting & Software sector, has experienced a recent evaluation adjustment due to changes in its technical indicators, which now reflect a bearish outlook. The company has faced declining profitability and negative results over recent quarters, despite maintaining a low debt-to-equity ratio.

Read MoreGTPL Hathway Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-25 08:05:41GTPL Hathway, a small-cap player in the TV Broadcasting & Software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 112.55, down from a previous close of 115.15, with a 52-week high of 196.00 and a low of 102.35. Today's trading saw a high of 116.40 and a low of 111.90. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) presents no signals for both weekly and monthly assessments. Bollinger Bands indicate bearish conditions weekly and mildly bearish monthly. Daily moving averages reflect a bearish stance, while the KST shows bearish trends for both weekly and monthly evaluations. The On-Balance Volume (OBV) presents no trend weekly but is bullish on a monthly basis. In t...

Read More

GTPL Hathway Faces Declining Profitability Amidst Technical Trend Shift

2025-03-24 08:09:06GTPL Hathway, a small-cap entity in the TV Broadcasting & Software sector, has recently seen a change in its evaluation, reflecting a shift in its technical trend. The company has faced significant challenges, including a decline in operating profit and profit after tax, while maintaining a low debt-to-equity ratio.

Read MoreGTPL Hathway Shows Mixed Technical Trends Amid Recent Stock Performance Evaluation

2025-03-24 08:02:44GTPL Hathway, a small-cap player in the TV Broadcasting & Software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 115.15, showing a notable increase from the previous close of 111.50. Over the past week, GTPL Hathway has demonstrated a stock return of 4.3%, slightly outperforming the Sensex, which returned 4.17% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on both weekly and monthly scales, and moving averages also reflect a mildly bearish stance on a daily basis. The KST and Dow Theory metrics present a mixed picture, with weekly indicators showing mild bullishness, contra...

Read More

GTPL Hathway Outperforms Sector Amid Broader Small-Cap Market Gains

2025-03-18 09:35:26GTPL Hathway, a small-cap company in the TV Broadcasting & Software sector, has experienced significant trading activity, outperforming its sector. The stock is currently above its short-term moving averages and offers a high dividend yield. In the broader market, small-cap stocks are leading, with the Sensex showing positive movement.

Read More

GTPL Hathway Stock Rises Amid Broader Market Volatility and Low Performance Metrics

2025-03-13 10:05:20GTPL Hathway's stock price increased today, although it remains near its 52-week low. The company has outperformed its sector slightly, despite trading below key moving averages. It offers a high dividend yield, appealing to income-focused investors. The broader market, represented by the Sensex, is also experiencing fluctuations.

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEPlease find attached intimation for Closure of Trading Window.

Intimation Under Regulation 30 Of The SEBI (LODR) Regulations 2015- Updates

31-Mar-2025 | Source : BSEUpdate on acquisition of equity stake in GTPL Vision Services Private Limited a subsidiary of the Company.

Intimation Under Regulation 30 Of The SEBI (LODR) Regulations 2015- Updates

28-Mar-2025 | Source : BSEIntimation under Regulation 30 of SEBI (LODR) Regulations 2015- Updates

Corporate Actions

No Upcoming Board Meetings

GTPL Hathway Ltd. has declared 40% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available