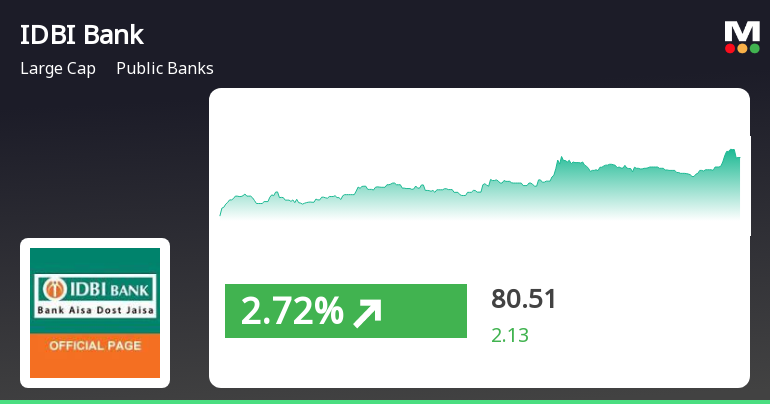

IDBI Bank Shows Resilience with Consecutive Gains Amid Market Volatility

2025-04-03 13:45:20IDBI Bank has demonstrated strong performance, achieving four consecutive days of gains and outperforming its sector. The stock's price is currently above several key moving averages, indicating a mixed trend. Meanwhile, the broader market, represented by the Sensex, has shown volatility but remains above its 50-day moving average.

Read More

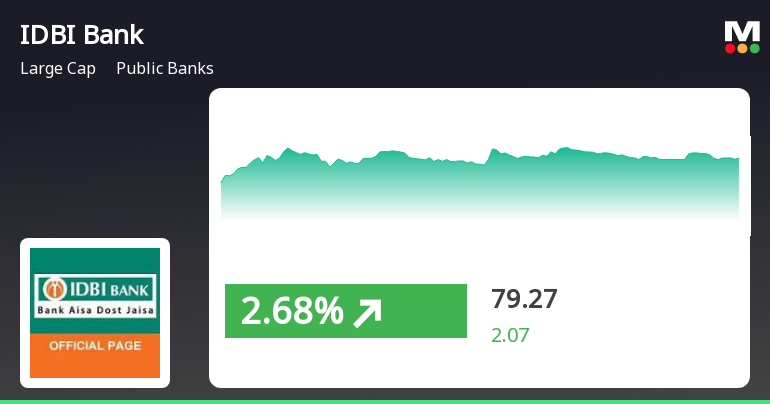

IDBI Bank Outperforms Sector Amid Broader Market Downturn, Signals Potential Resilience

2025-03-28 10:05:21IDBI Bank has experienced a notable uptick, gaining 3.1% on March 28, 2025, following four days of decline. The stock is currently above several moving averages, indicating mixed short to medium-term performance. Over the past month, IDBI Bank has significantly outperformed the broader market.

Read More

IDBI Bank Adjusts Evaluation Amid Shifting Market Sentiment and Strong Financial Metrics

2025-03-27 08:06:48IDBI Bank has recently experienced an evaluation adjustment reflecting current market dynamics, with technical indicators suggesting a shift in sentiment. The bank maintains strong financial metrics, including a favorable price-to-earnings ratio and low non-performing assets, while demonstrating solid long-term performance and operational efficiency.

Read MoreIDBI Bank Experiences Mixed Technical Trends Amid Market Volatility and Strong Historical Returns

2025-03-26 08:02:12IDBI Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 78.57, down from a previous close of 80.92, with a notable 52-week high of 107.98 and a low of 65.89. Today's trading saw a high of 81.82 and a low of 78.13, indicating some volatility in its performance. In terms of technical indicators, the bank's MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands also reflect a similar pattern, with weekly metrics indicating mild bullishness and monthly metrics showing a bearish stance. Moving averages on a daily basis suggest a mildly bearish trend, while the KST indicates a mildly bullish trend on a weekly basis but shifts to mildly bearish on a monthly scale. When comparing IDBI Bank's perform...

Read More

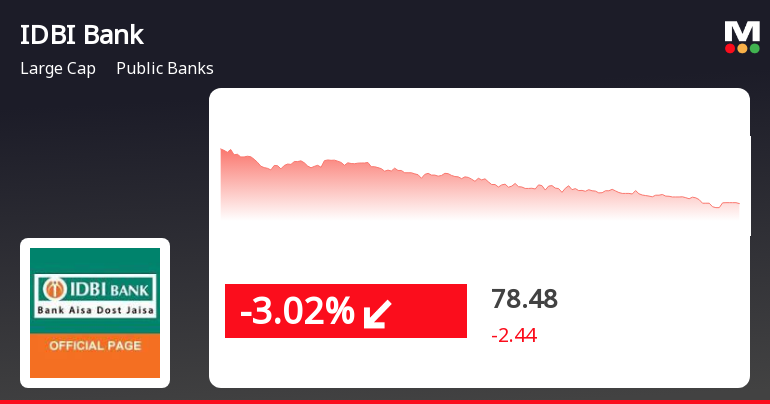

IDBI Bank Faces Short-Term Challenges Amidst Strong Long-Term Performance Trends

2025-03-25 11:45:29IDBI Bank's stock has faced a decline today, continuing a two-day downward trend. Despite this short-term setback, the bank has shown strong performance over the past week and month, outperforming the Sensex. Its moving averages indicate a mixed trend, reflecting varying performance metrics.

Read MoreIDBI Bank Shows Mixed Technical Trends Amidst Notable Market Volatility

2025-03-25 08:02:31IDBI Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 80.92, slightly down from the previous close of 81.35. Over the past year, IDBI Bank has experienced a 52-week high of 107.98 and a low of 65.89, indicating notable volatility. In terms of technical indicators, the bank's weekly MACD and KST suggest a mildly bullish sentiment, while the monthly metrics present a more mixed picture with some indicators leaning towards a bearish outlook. The Bollinger Bands indicate a mildly bullish trend on a weekly basis, while moving averages show a bearish tendency in the short term. When comparing IDBI Bank's performance to the Sensex, the bank has demonstrated strong returns over various periods. For instance, in the last week, IDBI Bank achieved a return of 11.98%, significantly outper...

Read More

IDBI Bank Adjusts Evaluation Amid Positive Technical Indicators and Strong Financial Performance

2025-03-24 08:05:02IDBI Bank has recently experienced an evaluation adjustment due to significant changes in its technical and valuation metrics. Positive trends in key technical indicators, alongside competitive valuation ratios and strong financial performance, highlight the bank's evolving market position and operational efficiency, which are important for stakeholders.

Read MoreIDBI Bank Shows Technical Trend Shifts Amidst Market Volatility and Strong Performance

2025-03-24 08:01:14IDBI Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 81.35, showing a notable increase from the previous close of 75.24. Over the past year, IDBI Bank has experienced a 52-week high of 107.98 and a low of 65.89, indicating significant volatility. In terms of technical indicators, the bank's weekly MACD and KST suggest a mildly bullish sentiment, while the monthly indicators present a mixed picture. The Bollinger Bands are signaling bullish trends on both weekly and monthly charts, which may reflect positive market sentiment. Additionally, the On-Balance Volume (OBV) indicates bullish momentum, further supporting the bank's current performance. When comparing IDBI Bank's returns to the Sensex, the bank has outperformed the index across various time frames. Over the past week, ...

Read MoreIDBI Bank Adjusts Valuation Grade Amid Competitive Public Banking Landscape

2025-03-24 08:00:29IDBI Bank has recently undergone a valuation adjustment, reflecting its current standing in the public banking sector. The bank's price-to-earnings ratio stands at 12.33, while its price-to-book value is recorded at 1.58. Additionally, IDBI Bank boasts a PEG ratio of 0.32 and a dividend yield of 1.84%. Key performance indicators include a return on equity of 12.83% and a return on assets of 1.99%. The net non-performing assets to book value ratio is notably low at 0.66, indicating a solid asset quality. In comparison to its peers, IDBI Bank's valuation metrics present a mixed picture. While it holds a relatively higher PE ratio compared to some competitors, several banks in the sector exhibit lower valuations, suggesting a competitive landscape. For instance, Bank of Baroda and Punjab National Bank have been noted for their attractive valuations, while Indian Overseas Bank appears to be on the higher end o...

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

09-Apr-2025 | Source : BSEIDBI Bank has given a public notice by way of advertisement in newspapers informing its shareholders regarding completion of dispatch of postal ballot notices and commencement of remote e-voting for the special business set-out therein. Pursuant to Regulation 30 read with Schedule III Para A of Part A of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we submit herewith copy of the notice published in newspapers on April 09 2025

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

08-Apr-2025 | Source : BSEAttached herewith is the Notice of Postal Ballot. Kindly acknowledge and take on record.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEAttached herewith the certificate under Reg. 74(5) of SEBI (DP) Regulations 2018. Kindly acknowledge receipt.

Corporate Actions

No Upcoming Board Meetings

IDBI Bank Ltd. has declared 15% dividend, ex-date: 16 Jul 24

No Splits history available

No Bonus history available

No Rights history available