Karnataka Bank's Stock Surges Amid Broader Market Volatility and Strong Returns

2025-04-03 14:00:27Karnataka Bank has experienced notable gains, marking its third consecutive day of increases and outperforming its sector. The stock is currently above several short-term moving averages and offers a high dividend yield. Despite recent volatility in the broader market, the bank has shown significant long-term growth over five years.

Read MoreKarnataka Bank Shows Mixed Technical Trends Amidst Market Challenges and Resilience

2025-04-02 08:03:19Karnataka Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 179.65, showing a slight increase from the previous close of 176.05. Over the past year, Karnataka Bank has faced challenges, with a notable decline of 24.41% in stock return compared to a modest gain of 2.72% in the Sensex. In terms of technical indicators, the bank's MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans towards a mildly bearish outlook. The Bollinger Bands and moving averages also indicate a mildly bearish stance, suggesting a cautious market sentiment. The KST reflects a bearish trend, further emphasizing the mixed signals present in the technical analysis. Despite the recent fluctuations, Karnataka Bank has demonstrated resilience over longer periods, with impressi...

Read MoreKarnataka Bank Faces Bearish Technical Trends Amid Fluctuating Market Performance

2025-03-27 08:01:06Karnataka Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 177.50, down from a previous close of 180.40, with a 52-week range between 162.20 and 245.00. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish conditions on a weekly basis, with mild bearishness noted monthly. The daily moving averages further support this trend, indicating a bearish stance. In terms of performance, Karnataka Bank's returns have varied significantly over different periods. Over the past week, the stock returned 0.82%, while the Sensex returned 2.44%. In the one-month frame, Karnataka Bank outperformed the Sensex slightly wit...

Read MoreKarnataka Bank's Stock Shows Mixed Technical Trends Amid Market Evaluation Revision

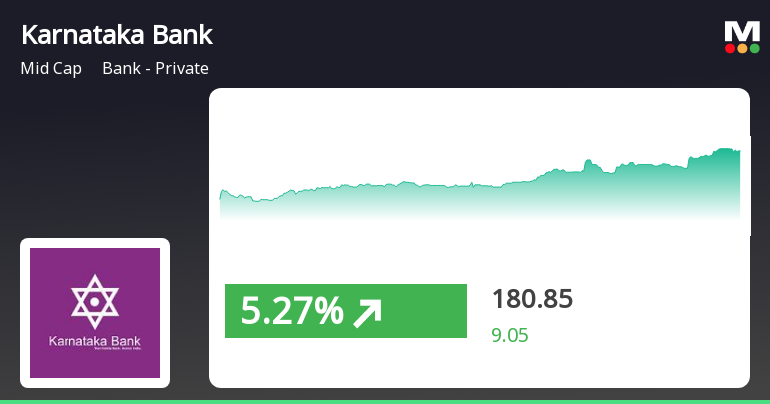

2025-03-21 08:01:00Karnataka Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 183.65, showing a notable increase from the previous close of 176.05. Over the past week, Karnataka Bank has demonstrated a stock return of 6.90%, significantly outperforming the Sensex, which returned 3.41% in the same period. In terms of technical indicators, the bank's performance is characterized by a mixed outlook. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands and On-Balance Volume (OBV) also indicate a mildly bearish trend, suggesting a cautious market sentiment. However, the Dow Theory presents a mildly bullish view on a weekly basis, indicating some underlying strength. Karnataka Bank's performance over various time frames reveals a s...

Read More

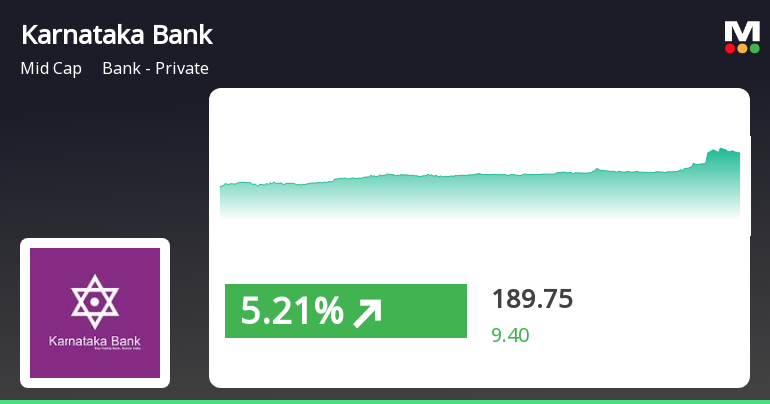

Karnataka Bank Outperforms Sector Amid Broader Market Gains and Bearish Trends

2025-03-06 14:30:22Karnataka Bank has demonstrated notable performance, gaining 5.36% on March 6, 2025, and achieving a total return of 10.15% over two days. The stock is currently above its short-term moving averages and offers a dividend yield of 3.2%, standing out amid a broader market trend.

Read More

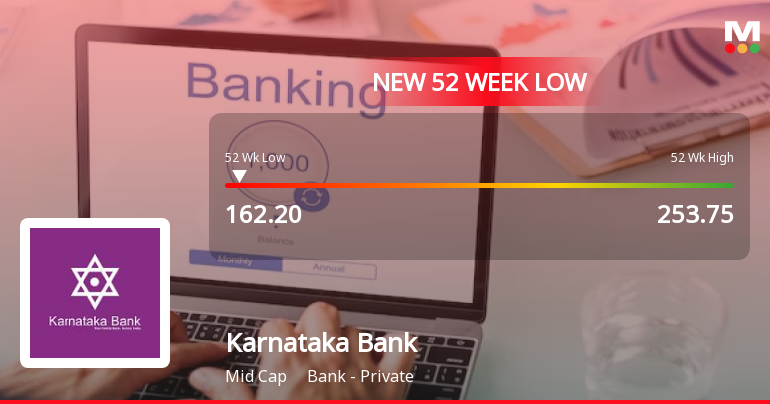

Karnataka Bank Faces Volatility Amid Broader Market Decline and Technical Weakness

2025-03-04 09:44:38Karnataka Bank's stock has hit a new 52-week low amid ongoing volatility, underperforming its sector and showing a bearish technical outlook. Despite challenges, the bank boasts a high dividend yield and strong lending practices, alongside a notable long-term growth potential, although its annual performance has been significantly negative.

Read More

Karnataka Bank Hits 52-Week Low Amid Ongoing Downward Trend and Sector Challenges

2025-03-03 09:35:35Karnataka Bank has reached a new 52-week low, continuing a downward trend with a 2.45% decline over the past four days. The stock is trading below all major moving averages and has decreased by 30.24% over the past year, contrasting with the marginal decline of the Sensex. The bank offers a dividend yield of 3.28%.

Read More

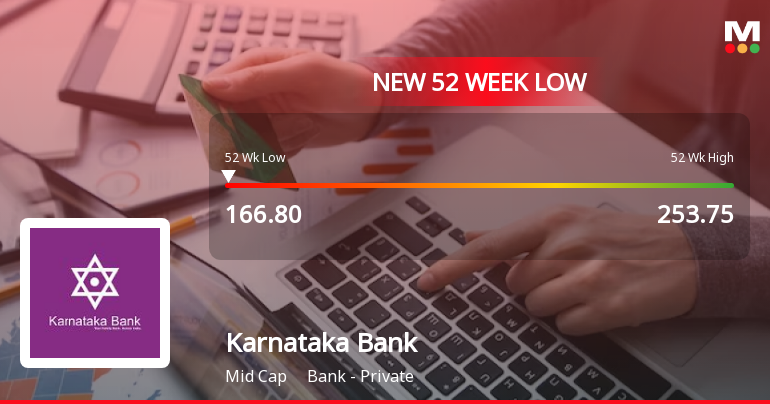

Karnataka Bank Hits 52-Week Low Amid Ongoing Downward Trend and Market Scrutiny

2025-02-28 09:35:44Karnataka Bank has reached a new 52-week low, continuing a downward trend with a 1.69% decline over the past three days. The stock is trading below all key moving averages and has decreased by 27.13% over the past year, contrasting with the Sensex's gains. It retains a high dividend yield of 3.23%.

Read More

Karnataka Bank Hits 52-Week Low Amidst Ongoing Sector Underperformance

2025-02-19 12:10:15Karnataka Bank has reached a new 52-week low, reflecting a challenging performance with a 32.03% decline over the past year. The stock is trading below multiple moving averages, indicating a bearish trend. Despite these challenges, it offers a high dividend yield of 3.23%.

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

08-Apr-2025 | Source : BSEChange in Senior Management

Announcement under Regulation 30 (LODR)-Change in Management

08-Apr-2025 | Source : BSEChange in the functional Responsibility of Senior Management of the Bank

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Karnataka Bank Ltd has declared 55% dividend, ex-date: 03 Sep 24

No Splits history available

Karnataka Bank Ltd has announced 1:10 bonus issue, ex-date: 17 Mar 20

Karnataka Bank Ltd has announced 1:2 rights issue, ex-date: 24 Oct 16