Rategain Travel Technologies Faces Mixed Technical Trends Amid Market Challenges

2025-04-03 08:06:27Rategain Travel Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 453.10, showing a slight increase from the previous close of 449.55. Over the past year, Rategain has faced challenges, with a notable decline of 37.87% compared to a 3.67% rise in the Sensex during the same period. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the weekly RSI remains bullish. However, the Bollinger Bands and On-Balance Volume (OBV) suggest a mildly bearish outlook. This mixed technical landscape highlights the complexities of Rategain's performance in the current market environment. In terms of returns, Rategain has shown a strong performance over the past three years, with a return of 31.79%, slightly outperforming the Sensex's 29.25% in the same...

Read MoreRategain Travel Technologies Faces Mixed Technical Trends Amid Market Volatility

2025-04-02 08:10:02Rategain Travel Technologies, a midcap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 449.55, showing a slight increase from the previous close of 444.80. Over the past year, Rategain has faced challenges, with a notable decline of 39.12%, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents a bullish signal weekly, but lacks a clear direction monthly. Bollinger Bands reflect a mildly bearish trend in both weekly and monthly assessments, while moving averages indicate bearish conditions on a daily basis. In terms of returns, Rategain has experienced a 3.3% in...

Read More

Rategain Travel Technologies Sees Valuation Upgrade Amid Strong Sales Growth and Profitability

2025-03-27 08:13:05Rategain Travel Technologies has recently experienced a change in its valuation grade, reflecting a more favorable assessment of the company. Key financial metrics show strong performance, including a PE ratio of 24.43 and significant growth in net sales and operating profit over the past year.

Read More

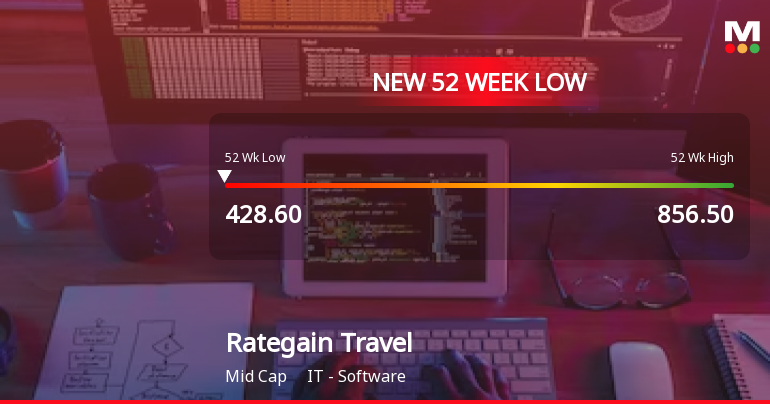

Rategain Travel Technologies Faces Stock Volatility Amid Strong Long-Term Growth Indicators

2025-03-26 13:39:32Rategain Travel Technologies has faced notable volatility, hitting a 52-week low and underperforming its sector. Despite recent stock declines, the company has demonstrated strong long-term growth with significant increases in net sales and operating profit, alongside a solid operational track record and favorable valuation metrics.

Read More

Rategain Travel Technologies Adjusts Valuation Amidst Strong Sales Growth and Market Challenges

2025-03-24 08:10:58Rategain Travel Technologies has recently experienced a change in its valuation grade, influenced by various financial metrics. The company reports a PE ratio of 26.70 and a price-to-book value of 3.50, alongside a notable annual growth rate in net sales of 48.04%, despite facing challenges this year.

Read MoreRategain Travel Technologies Adjusts Valuation Amid Mixed Industry Performance Metrics

2025-03-24 08:01:11Rategain Travel Technologies has recently undergone a valuation adjustment, reflecting its current market position within the IT software industry. The company's price-to-earnings ratio stands at 26.70, while its price-to-book value is recorded at 3.50. Key performance indicators such as the EV to EBIT ratio are at 26.85, and the EV to EBITDA ratio is noted at 22.56. The company's return on capital employed (ROCE) is 14.86%, and return on equity (ROE) is at 12.07%. In comparison to its peers, Rategain's valuation metrics present a mixed picture. For instance, Zensar Technologies has a lower PE ratio of 23.67 and a more favorable EV to EBITDA of 17.27. On the other hand, companies like Newgen Software and Indiamart International exhibit significantly higher valuation metrics, indicating a more premium market positioning. Rategain's stock performance has shown volatility, with a year-to-date return of -36....

Read More

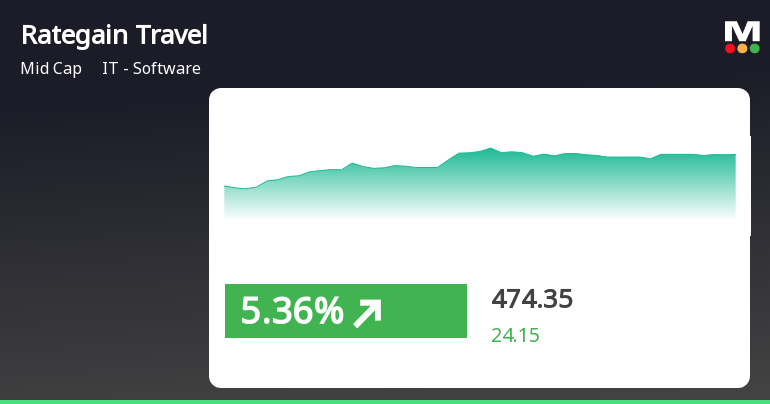

Rategain Travel Technologies Shows Positive Momentum Amid Mixed Market Conditions

2025-03-21 09:50:29Rategain Travel Technologies has experienced significant activity, achieving consecutive gains and outperforming its sector. The stock's performance is mixed when compared to various moving averages. Meanwhile, the broader market shows a rebound, with small-cap stocks leading the way amid a complex market environment.

Read More

Rategain Travel Technologies Reports Strong Growth Amid Market Challenges and Low Debt Levels

2025-03-17 10:37:46Rategain Travel Technologies has recently adjusted its evaluation, reflecting strong performance metrics. The company reported a 48.04% annual growth in net sales and a 148.60% increase in operating profit for Q3 FY24-25. Rategain has shown consistent positive results over 11 quarters, with a solid financial structure and favorable investor confidence.

Read More

Rategain Travel Technologies Faces Volatility Amid Broader Market Resilience and Growth Metrics

2025-03-17 09:57:12Rategain Travel Technologies has hit a new 52-week low, reflecting significant volatility and a decline over the past six days. Despite this, the company reports strong long-term growth metrics and maintains a low debt-to-equity ratio, although its one-year performance contrasts with broader market gains.

Read MoreClosure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window

Announcement under Regulation 30 (LODR)-Press Release / Media Release

20-Mar-2025 | Source : BSERateGain Appoints Anurag Jain as Executive Vice President- APMEA

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

20-Mar-2025 | Source : BSEAllotment of Equity Shares under RateGain Employees Stock Option Scheme- 2015 2018 and SAR 2022

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available