Rushil Decor Faces Significant Challenges Amidst Broader Market Resilience

2025-03-27 11:36:05Rushil Decor, a microcap in the Wood & Wood Products sector, is nearing a 52-week low, having declined consecutively over three days. The company's fundamentals are weak, with disappointing financial results and a high Debt to EBITDA ratio, contrasting sharply with the broader market's recent recovery.

Read More

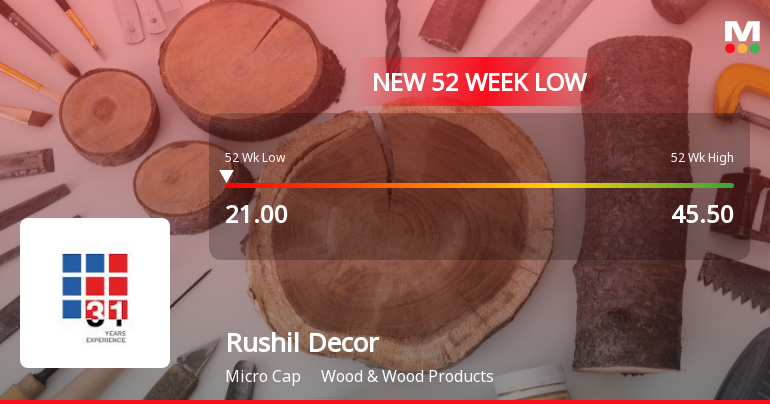

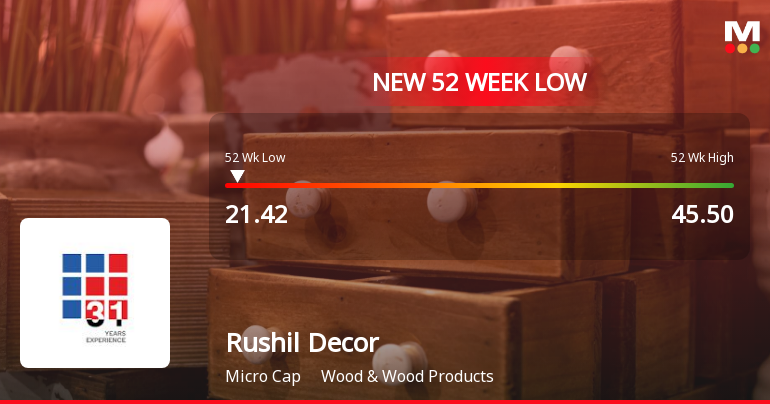

Rushil Decor Hits New Low Amid Ongoing Financial Struggles and Sector Underperformance

2025-03-26 15:37:54Rushil Decor, a microcap in the Wood & Wood Products sector, has reached a new 52-week low, continuing a downward trend with significant declines over recent days. The company faces financial challenges, including a high Debt to EBITDA ratio and poor quarterly results, reflecting ongoing struggles in performance.

Read MoreRushil Decor Adjusts Valuation Grade Amidst Competitive Industry Landscape

2025-03-26 08:00:20Rushil Decor, a microcap player in the Wood & Wood Products industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price is 22.50, with a previous close of 23.62, and it has seen a 52-week high of 45.50 and a low of 22.00. Key financial metrics for Rushil Decor include a PE ratio of 13.97, a price-to-book value of 1.05, and an EV to EBITDA ratio of 7.88. The company also boasts a dividend yield of 0.44% and a return on capital employed (ROCE) of 10.07%. In comparison to its peers, Rushil Decor's valuation metrics stand out, particularly when juxtaposed with companies like Duroply Industries and Archidply Industries, which have higher PE ratios and EV to EBITDA values. Despite recent stock performance showing declines over various periods, including a 32.68% drop year-to-date, Rushil Decor's long-term performance remains notable, with ...

Read More

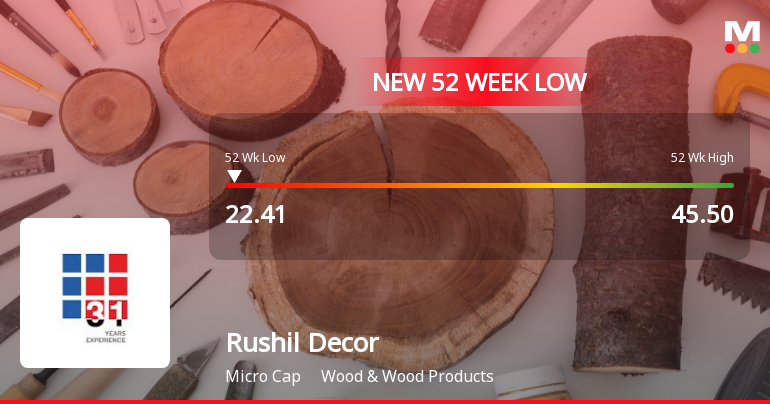

Rushil Decor Hits 52-Week Low Amid Broader Market Gains and Investor Caution

2025-03-17 09:43:25Rushil Decor, a microcap in the Wood & Wood Products sector, has reached a new 52-week low, reflecting significant underperformance with a one-year return of -24.54%. The stock remains below key moving averages, and its fundamentals indicate weak long-term strength, raising concerns about its financial stability.

Read More

Rushil Decor Hits 52-Week Low Amid Broader Market Resilience and Financial Struggles

2025-03-17 09:43:21Rushil Decor, a microcap in the Wood & Wood Products sector, has hit a new 52-week low, reflecting a challenging year with a 24.54% decline in stock price. The company shows weak long-term fundamentals, including a low Return on Capital Employed and a high Debt to EBITDA ratio.

Read More

Rushil Decor Faces Financial Struggles Amidst Declining Sales and High Debt Concerns

2025-03-13 09:40:15Rushil Decor, a microcap in the Wood & Wood Products sector, has faced significant volatility, reaching a new 52-week low. The company reported declining net sales and profit before tax, alongside weak long-term fundamentals and high debt levels. Institutional investor interest remains low, with no domestic mutual fund investments.

Read More

Rushil Decor Faces Significant Volatility Amid Weak Financial Performance and Market Trends

2025-03-13 09:40:00Rushil Decor, a microcap in the Wood & Wood Products sector, has faced notable volatility, reaching a 52-week low. The company reported net sales of Rs. 210.39 crore and a profit before tax of Rs. 12.26 crore, with weak long-term fundamentals and a declining stock performance over the past year.

Read More

Rushil Decor Faces Financial Struggles Amid Broader Market Decline and Volatility

2025-03-12 10:37:09Rushil Decor, a microcap in the Wood & Wood Products sector, has hit a 52-week low and is experiencing a significant decline, underperforming its sector. The company faces financial challenges, including low ROCE and high debt levels, while its sales and profits have also decreased in recent quarters.

Read More

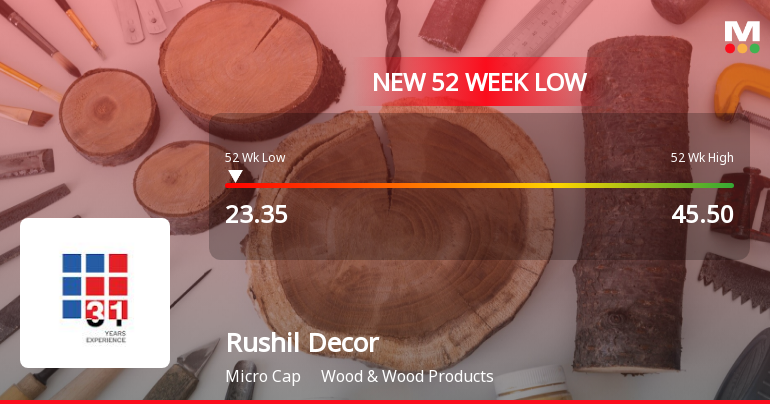

Rushil Decor Faces Sustained Underperformance Amidst Market Volatility and Declining Trends

2025-03-03 10:35:45Rushil Decor, a microcap in the Wood & Wood Products sector, reached a new 52-week low today, continuing a six-day downward trend with a cumulative decline of 16.94%. The stock is trading below all major moving averages and has dropped nearly 30% over the past year, underperforming the broader market.

Read MoreAnnouncement under Regulation 30 (LODR)-Strikes /Lockouts / Disturbances

09-Apr-2025 | Source : BSEIntimation about Fire at Atchutapuram MDF Manufacturing Plant

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018.

Closure of Trading Window

27-Mar-2025 | Source : BSEIntimation of closure of Trading window

Corporate Actions

No Upcoming Board Meetings

Rushil Decor Ltd has declared 10% dividend, ex-date: 13 Sep 24

Rushil Decor Ltd has announced 1:10 stock split, ex-date: 09 Aug 24

No Bonus history available

Rushil Decor Ltd has announced 1:3 rights issue, ex-date: 13 Apr 23