Suraj Estate Developers Faces Technical Trend Shifts Amid Market Volatility

2025-04-02 08:10:37Suraj Estate Developers, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 321.95, showing a notable shift from its previous close of 302.50. Over the past week, the stock has experienced a high of 330.50 and a low of 308.40, indicating some volatility. In terms of technical indicators, the weekly MACD remains bearish, while the daily moving averages also reflect a bearish sentiment. The Bollinger Bands indicate a mildly bearish trend, suggesting a cautious outlook in the short term. Notably, the Relative Strength Index (RSI) shows no signal on both weekly and monthly charts, indicating a lack of momentum in either direction. When comparing the stock's performance to the Sensex, Suraj Estate Developers has shown mixed results. Over the past week, the stock returned 1%, while ...

Read More

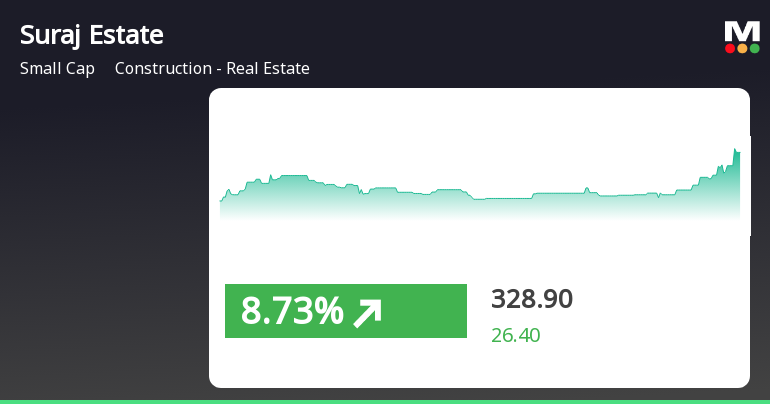

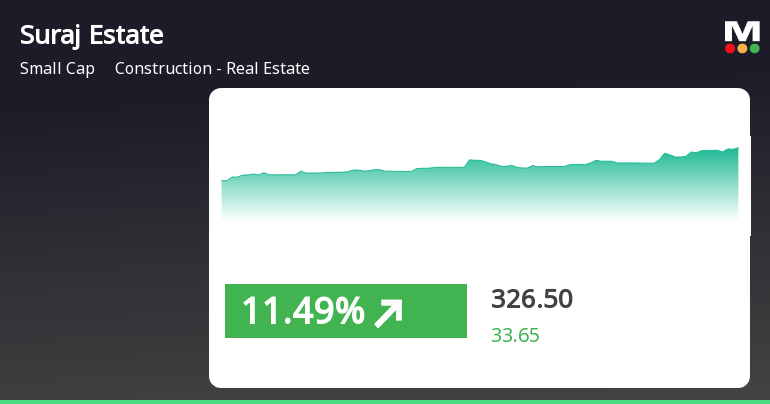

Suraj Estate Developers Shows Resilience Amid Broader Market Decline in Real Estate Sector

2025-04-01 15:35:31Suraj Estate Developers saw a notable increase in stock performance today, significantly outperforming the broader construction and real estate sector, which declined. The stock exhibited high volatility and is currently positioned above its short-term moving averages, despite a generally bearish market sentiment.

Read MoreSuraj Estate Developers Adjusts Valuation Amidst Diverse Market Conditions and Competitive Metrics

2025-04-01 08:00:56Suraj Estate Developers, a small-cap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's current price stands at 302.50, reflecting a notable decline from its previous close of 313.60. Over the past year, Suraj Estate has shown a return of 15.9%, outperforming the Sensex, which recorded a 5.11% return in the same period. Key financial metrics for Suraj Estate include a PE ratio of 20.25 and an EV to EBITDA ratio of 10.94, indicating its market positioning relative to its peers. The company also reports a return on capital employed (ROCE) of 18.01% and a return on equity (ROE) of 12.29%. In comparison, peers in the industry exhibit a wide range of valuation metrics, with some companies facing significant challenges, such as loss-making positions and high PE ratios, while others maintain more attractive valuations. This evaluation revision highligh...

Read MoreSuraj Estate Developers Adjusts Valuation Grade Amidst Competitive Real Estate Landscape

2025-03-24 08:01:17Suraj Estate Developers has recently undergone a valuation adjustment, reflecting its current standing in the construction and real estate sector. The company’s price-to-earnings ratio stands at 22.51, while its price-to-book value is recorded at 2.77. Additionally, the enterprise value to EBITDA ratio is 11.97, indicating a robust performance in terms of earnings relative to its valuation. Despite a challenging year-to-date return of -44.46%, Suraj Estate has shown resilience with a one-year return of 22.35%, outperforming the Sensex, which returned 5.87% over the same period. The company's return on capital employed (ROCE) is at 18.01%, and its return on equity (ROE) is 12.29%, suggesting effective management of resources. In comparison to its peers, Suraj Estate's valuation metrics indicate a higher positioning, particularly when contrasted with companies like Ceigall India and Capacit'e Infra, which h...

Read More

Suraj Estate Developers Shows Resilience Amid Market Volatility and Sector Gains

2025-03-21 10:50:31Suraj Estate Developers has demonstrated notable activity, achieving consecutive gains over four days and outperforming its sector. The stock reached an intraday high, reflecting significant volatility and active trading. Despite recent fluctuations, it has shown resilience in year-to-date performance, although it remains down for the year.

Read MoreSuraj Estate Developers Opens Strong with 7.72% Gain Amid Market Fluctuations

2025-03-19 09:35:22Suraj Estate Developers, a small-cap player in the construction and real estate sector, has shown significant activity today, opening with a notable gain of 7.72%. The stock's performance has outpaced its sector by 2.03%, reflecting a positive trend over the last two days, during which it has accumulated a total return of 3.38%. Today, Suraj Estate reached an intraday high of Rs 309, marking a strong start to the trading session. However, despite this recent uptick, the stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend in the longer term. In terms of broader market performance, Suraj Estate Developers recorded a 1.46% increase today, compared to a modest 0.12% rise in the Sensex. Over the past month, the stock has faced challenges, declining by 10.18%, while the Sensex has only dipped by 0.72%. With a beta of 1.63, Suraj Estate ...

Read MoreSuraj Estate Developers Adjusts Valuation Amidst Competitive Real Estate Landscape

2025-03-11 08:00:52Suraj Estate Developers, a small-cap player in the construction and real estate sector, has recently undergone a valuation adjustment. The company's current price stands at 308.50, reflecting a notable decline from its previous close of 337.00. Over the past year, Suraj Estate has experienced a stock return of -7.12%, contrasting with a marginal change in the Sensex, which remained nearly flat at -0.01%. Key financial metrics for Suraj Estate include a PE ratio of 20.65 and an EV to EBITDA ratio of 11.12. The company also reports a return on capital employed (ROCE) of 18.01% and a return on equity (ROE) of 12.29%. These figures indicate a solid operational performance relative to its market position. In comparison to its peers, Suraj Estate's valuation metrics present a mixed picture. While some competitors are categorized as risky with significantly higher PE ratios, others show more attractive valuation...

Read More

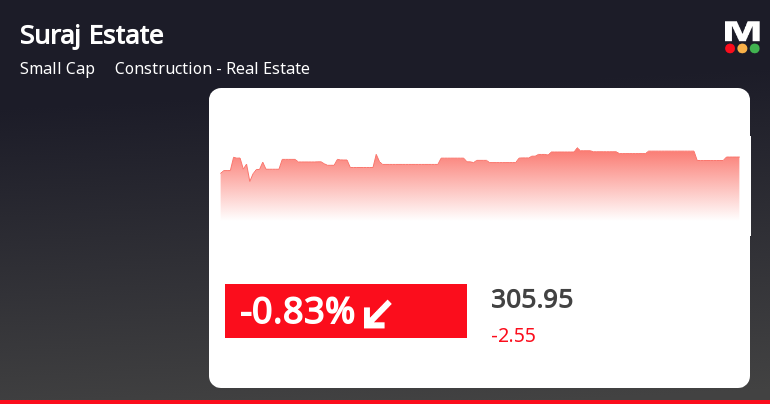

Suraj Estate Developers Faces Significant Stock Volatility Amid Broader Market Gains

2025-03-10 14:20:28Suraj Estate Developers, a small-cap construction and real estate firm, faced significant stock volatility today, with a notable decline following an initial gain. The stock has underperformed its sector and experienced consecutive losses over the past two days, reflecting a challenging market position amid broader market trends.

Read MoreSuraj Estate Developers Opens Strong with 6.32% Gain Amid Market Trends

2025-03-06 10:50:19Suraj Estate Developers, a small-cap player in the construction and real estate sector, has shown significant activity today, opening with a gain of 6.32%. The stock has outperformed its sector by 2.11%, marking a notable performance amid broader market trends. Over the past three days, Suraj Estate has experienced a consecutive gain, accumulating a total return of 11.43%. Today, the stock reached an intraday high of Rs 339.9, reflecting its upward momentum. However, while it is currently above its 5-day moving averages, it remains below the 20-day, 50-day, 100-day, and 200-day moving averages, indicating mixed signals in its longer-term performance. In terms of market performance, Suraj Estate Developers has shown a 1-day return of 2.89%, significantly outperforming the Sensex, which recorded a mere 0.08%. However, the stock's 1-month performance reveals a decline of 27.09%, contrasting with the Sensex's...

Read MoreVoting Results Under Regulation 44(3) Of SEBI(LODR) Regulations 2015 In Respect Of EGM Held On April 01 2025

02-Apr-2025 | Source : BSEVoting Results under Regulation 44(3) of SEBI (LODR) Regulations 2015 in respect of EGM held on April 01 2025

Shareholder Meeting / Postal Ballot-Scrutinizers Report

01-Apr-2025 | Source : BSEScrutinizers Report on remote e-voting prior to and e-voting at Extra Ordinary General Meeting of the members of Suraj Estate Developers Limited held on April 01 2025

Shareholder Meeting / Postal Ballot-Outcome of EGM

01-Apr-2025 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we hereby inform you that the Extra-Ordinary General Meeting (EGM) of the Members of the Company was held on Tuesday April 01 2025 at 12:30 p.m. through Video Conferencing (VC) / Other Audio Visual Means (OAVM). In this connection we enclose the summary of the proceedings of the EGM as required under Regulation 30 read with Para (A) (13) of Part A of Schedule III to the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 vide Annexure - I.

Corporate Actions

No Upcoming Board Meetings

Suraj Estate Developers Ltd has declared 20% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available