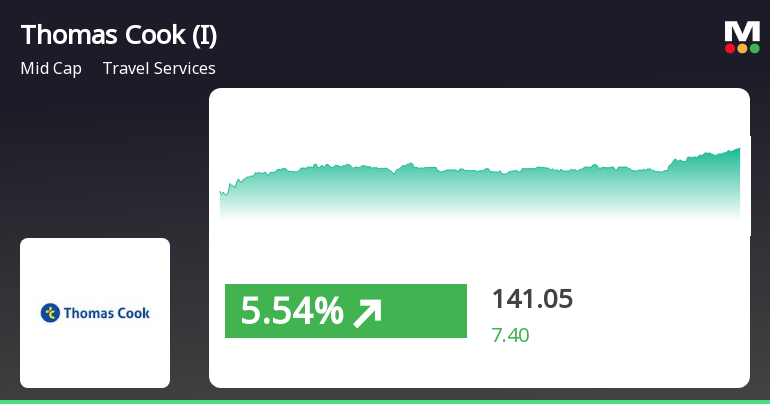

Thomas Cook (India) Faces Mixed Technical Trends Amid Market Volatility

2025-03-25 08:05:01Thomas Cook (India), a midcap player in the travel services industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 142.00, showing a slight increase from the previous close of 140.65. Over the past year, the stock has experienced significant volatility, with a 52-week high of 264.00 and a low of 118.40. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. Notably, the Bollinger Bands and KST also reflect a bearish outlook on a weekly basis. The Dow Theory presents a mildly bullish signal weekly, contrasting with the overall bearish indicators. In terms of performance, Thomas Cook has shown varied returns compared to the Sensex. Over the past week, the stock returned 14.29%, significantly outperforming the Sensex's 5.14%. However, on a ye...

Read More

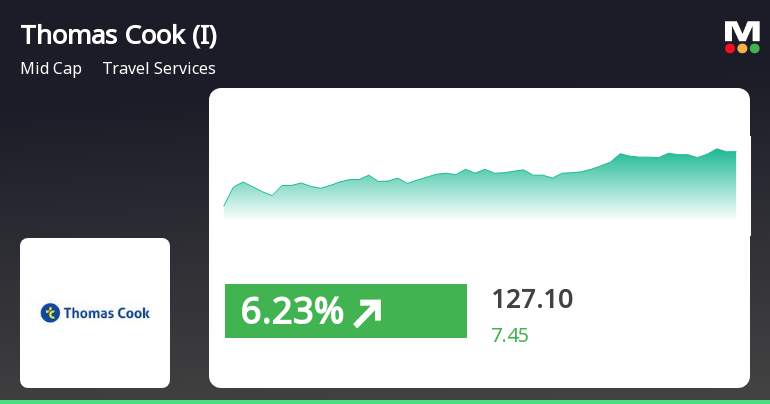

Thomas Cook (India) Experiences Short-Term Gains Amid Long-Term Volatility Challenges

2025-03-21 14:20:22Thomas Cook (India) experienced notable gains today, outperforming the travel services sector and the Sensex in one-day performance. However, its longer-term metrics indicate a decline over the past three months and year-to-date, despite a substantial increase over the past five years, highlighting a mixed performance landscape.

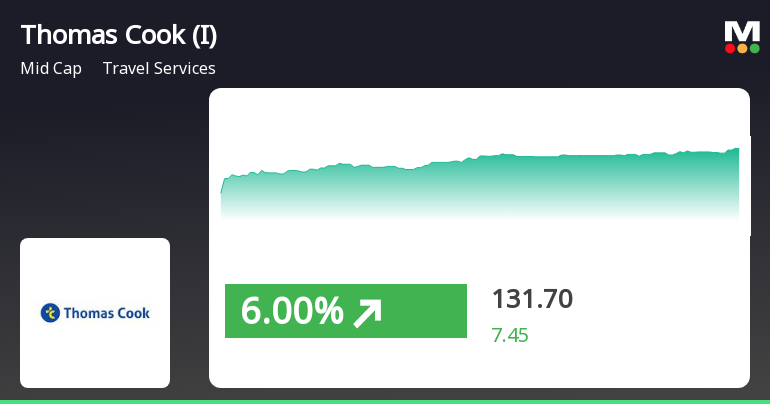

Read MoreThomas Cook (India) Shows Mixed Technical Trends Amid Market Fluctuations

2025-03-19 08:04:09Thomas Cook (India), a midcap player in the travel services industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 132.25, showing a notable increase from the previous close of 124.25. Over the past year, the stock has experienced fluctuations, with a 52-week high of 264.00 and a low of 118.40. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands also reflect a mildly bearish trend, suggesting some caution in the market. Meanwhile, the On-Balance Volume (OBV) indicates a mildly bullish sentiment on both weekly and monthly scales, which may suggest some underlying strength. In terms of returns, Thomas Cook's performance has varied significantly compared to the Sensex. Over the past week, the ...

Read More

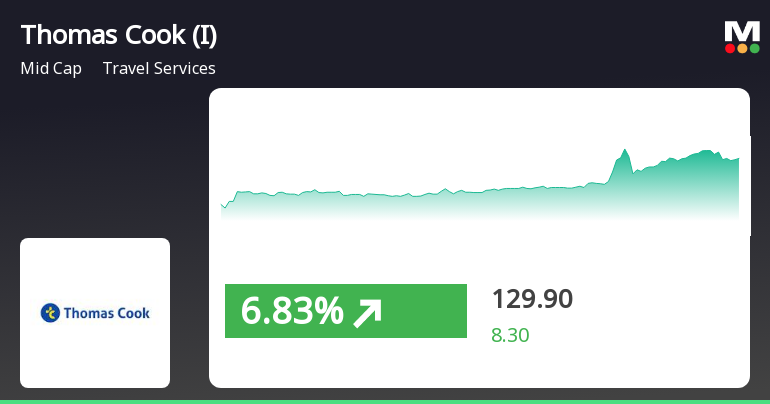

Thomas Cook (India) Shows Signs of Recovery Amidst Mixed Market Signals

2025-03-18 10:35:27Thomas Cook (India) has seen a significant rebound, gaining 5.03% after four days of decline. The stock outperformed the Travel Services sector and the Sensex in recent performance metrics, although it remains under pressure year-to-date with a notable decline compared to the broader market.

Read More

Thomas Cook (India) Faces Significant Stock Decline Amid Broader Market Trends

2025-03-11 14:20:21Thomas Cook (India) has seen a significant decline in its stock today, opening lower and reaching an intraday low. While the company has shown a positive trend over the past week, its longer-term performance indicates challenges, with notable declines over the past three months and year-to-date. The broader market shows slight recovery.

Read More

Thomas Cook (India) Shows Mixed Performance Amid Broader Market Gains and Volatility

2025-03-05 11:10:25Thomas Cook (India) experienced significant trading activity, outperforming its sector with a notable intraday high. The stock displayed high volatility and mixed performance trends in relation to various moving averages. Meanwhile, the broader market saw gains, particularly in mid-cap stocks, despite lingering challenges for the Sensex.

Read MoreThomas Cook (India) Faces Bearish Technical Trends Amid Market Evaluation Revision

2025-03-05 08:02:46Thomas Cook (India), a midcap player in the travel services industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 121.60, down from a previous close of 125.10, with a notable 52-week high of 264.00 and a low of 118.40. Today's trading saw a high of 125.00 and a low of 119.80. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly periods. Moving averages and KST further support this bearish sentiment, with the Dow Theory indicating a mildly bullish trend on a weekly basis but no clear trend monthly. In terms of performance, Thomas Cook's stock has faced challenges compared to the Sensex. Over the past week, the stock returned -6.43%,...

Read More

Thomas Cook (India) Stock Surges Amid Broader Market Volatility in Travel Sector

2025-02-20 10:05:24Thomas Cook (India) has experienced notable stock activity, rising significantly on February 20, 2025, and achieving consecutive gains over two days. Despite this recent performance, the stock remains below its moving averages and has faced challenges over the past month, contrasting with broader market trends.

Read More

Thomas Cook (India) Faces Increased Volatility Amid Broader Sector Decline

2025-02-18 11:57:13Thomas Cook (India) faced notable volatility in trading on February 18, 2025, reaching a new 52-week low. The stock has seen consecutive losses over four days and is trading below key moving averages, reflecting a bearish trend. The overall sector also experienced a decline during this period.

Read MoreAnnouncement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSEWe are enclosing herewith the Press Release of M/s. Sterling Holiday Resorts Limited wholly owned subsidiary of M/s. Thomas Cook (India) Limited dated April 7 2025 titled Sterling Debuts in Punjab with the Launch of Sterling Borderland Amritsar.

Intimation Under Regulation 30 Read With Para A Of Part A Of Schedule III Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

04-Apr-2025 | Source : BSEIntimation under Regulation 30 read with Para A of Part A of Schedule III of the SEBI ( Listing Obligations and Disclosure Requirements) Regulations 2015.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

03-Apr-2025 | Source : BSEWe are enclosing herewith the Press Release dated April 3 2025 titled Thomas Cook Indias Foreign Exchange business appoints Bollywood star Kartik Aaryan as Brand Ambassador.

Corporate Actions

No Upcoming Board Meetings

Thomas Cook (India) Ltd has declared 40% dividend, ex-date: 16 Aug 24

Thomas Cook (India) Ltd has announced 1:10 stock split, ex-date: 14 May 07

No Bonus history available

Thomas Cook (India) Ltd has announced 35:100 rights issue, ex-date: 19 Dec 08